What happens when our mind gets in the way of our money? In today’s episode, we’re exploring the “wealth journey” and how our beliefs and emotions play a role in whether or not you’re experiencing the wealth and abundance you desire.

No matter where you are on your wealth journey, there’s always another level to break through. I urge you to listen to this episode with a fresh pair of ears and consider that there’s yet another level of mastery ahead of you. This is a journey without a destination and we get to decide when we get on or off the ride. You’re in complete control of your destiny, so take this time to open your mind and broaden your awareness of a deeper level of wealth.

[00:00:00] Jeffrey: Welcome to the light in your launch podcast today, we're talking about making money. Don't wanna miss this stay tuned.

[00:00:55] Jeffrey: Welcome back to the show. I'm Jeff Sorano. I'm back again with, of course the Katie Collins. And today we want to talk about where making life changing money really begins, and you might already be on this journey. Here's a hint. It's not a big paycheck. It's not a successful launch. It's not another business loan.

It's your mindset, AKA your beliefs about money, Katie. Wouldn't you agree?

[00:01:27] Katie: I would absolutely agree. And the good news is I feel like I've made major shifts in the way I was raised versus the way I live my life today around money. So I want to set this conversation up with understanding that you too, we acknowledge that you too are really on this journey. Right. And you've probably come, you know, from here to there already.

Um, or from there to here, Um, but you know, there's always just. More steps along the way or more kinks to iron out things still come up. Um, and you know, this really came up in conversation between the two of us and we were like, all right, let's open this up for, for a chat. So.

[00:02:14] Jeffrey: Yeah. And, and I kind of wanna frame this by sharing, um, a little bit about my. Childhood, I guess just where I came from, where my money beliefs kind of came from. Like, uh, I didn't grow up in a, in a household that had a lot of amenities. Um, my family, my immediate family, mom and dad, and I have a brother. We grew up on a farm.

Uh, but it wasn't our farm. So we lived in a caretaker home and my dad worked on, on the ranch for somebody else. Right. So, um, I really kind of came from a place where we were part of somebody else's land or somebody else's income or somebody else's riches or somebody else's. It was always somebody else's.

And, um, you know, it was a big deal when we got our TV, it was a big deal when we. An Nintendo. It was a big deal when we got a VCR, you know, all of these things were like,

[00:03:21] Katie: Yep.

[00:03:21] Jeffrey: I pick out the tech stuff, right?

[00:03:23] Katie: Yep.

[00:03:25] Jeffrey: I'm like gadgets. Yes. Gadgets. Like these were always big deals and, and you know, now buying a TV, they're like, why don't you have four.

Why don't you have four TVs in your house? It's kind of weird, you know, I don't know. It's, it's a different time, but, um, growing up in a, in a, an environment like that, where, um, my family did say, oh, we can't afford that. Or, um, wow, that's a lot of money. Or, you know, maybe we'll take a vacation next year or, you know, there was, there was a lot of that going on and it's in my DNA.

So I've had a lot of work to reverse that and come out.

[00:04:05] Katie: Mm-hmm . That's interesting. I didn't know that about you.

[00:04:08] Jeffrey: Yeah, this

[00:04:10] Katie: oh, I'm learning about Jeffrey. I know. So sweet. Um, you know, I had, yeah, my upbringing certainly was not, um, I wouldn't categorize it as wealthy. I think we were lucky. We, we owned our own home and I didn't even understand as a kid that, that in and of itself was a step above other people.

Um, but we also had five people living in a very small house. and I shared a room with my sister, my whole life, and we prioritized my parents prioritized good teeth and Catholic. And that is what they put their money towards. And so we often heard the, I can't afford it as well. Um, I remember my mom, you know, if we wanted clothes that were not from JC penny, then my mom would say, go ahead and use your babysitting money and buy the clothes you wanna buy.

So I probably bought my own clothes starting at age 11. Um, I had my first job at age 10 and so I do value working. I value making my own money and I value spending my money. On things that I choose. And those are things that I've realized as an adult stemmed from not being handed everything as a child, um, and just learning how to work for, for what I want.

And also valuing, you know, how much do I value this Louis Vuitton purse? You know, do I really care about having a person that everybody else has at my high school? Uh, not so much, right. Like there are other things I valued more, so I've never really been the name brand girl. Um, I've always liked to look good, but I've never cared about spending hundreds or thousands of dollars on jewelry or purses or.

Um, because that just, I just never cared. So it's just interesting. And I think I just, we share this with you because we want you to think about like, you know, how are you raised and, and how do you make buying decisions today? That might be based on. How you're raised and either how you overcame that, or are you still living in, in it?

Um, I try really hard to never use the words I can't afford. It. That's been a really big journey of mine is to reframe it with I'm choosing not to invest in that right now. Right. Or I've already invested in X, Y, Z. So now's not the right time to invest in this too. Um, but you know, to say, I can't afford, it feels.

Like I'm devaluing all the work I've done and all the money I've made and you know, it's just about choices.

[00:06:45] Jeffrey: You're omitting the choice. You're saying the universe has made that choice for me because I'm incapable of it. Or, you know, there there's, it's disempowering for sure.

[00:06:53] Katie: it is it's disempowering. Um, so I know you were.

[00:06:57] Jeffrey: put real quick while we're talking about this background, like depending on where you are, dear listener on your journey, like if you could be in the very beginning of it, this, this could be old news, but if you are right there in the kind of beginning of this journey, that's where you start, start with looking at the environment you grew up in and because your parents, whether.

Believe it or not whether or not you admit it or not, your parents' beliefs and their actions, they rubbed off on you in some way. Now, now sometimes, sometimes they rub off you in an opposite way where they always said they couldn't afford it, blah, blah, blah. They couldn't afford it. They lived in poverty.

You took that on and say, I will never. I believe I will never say that. And I won't do that. You in, you have a different journey. Right. So even in that case, those thoughts and beliefs rubbed off on you, or you took them on and you said, oh yeah, well, I'm the kind of person who is lives in poverty, or I'm the kind of person who never has money, where a family that never has money, therefore.

And poor, you know what I mean? Like it rubs off on you in one way or another. So that's the first acknowledgement really is to understand where you are now is a condition. Is, is the result of your childhood condition.

[00:08:29] Katie: Mm-hmm Um, and I, I think, yeah, it's just, it's important to note the, um, Whether or not you've gone in the direction you grew up with or not. Right. so some of us are like, I'm never saying that again. Or, um, you know, they, some of us have made making money more important than anything else, because you did not want to relive what you did as a child or what you saw your parents do.

Um, so, and, and for a lot of people, it's, you're the first generation that went to college. That was true for me. Um, you know, my sister and I were the first people in our family to graduate college. Um, and so, you know, that in and of itself was such a, um, celebration for my parents, that we were able to be more successful than what they had been able to achieve.

Um, but it's interesting, you know, no matter how much money you make. Like, if you did go to college and you got the, the fancy degree and made a bunch of money, or you skipped it and, you know, did the entrepreneurial path or somewhere in between. Right. And you did earn and have been earning a pretty good amount of money.

If you still have some of these mindsets that you grew up with around. Not wanting to invest in expensive clothes or shoes, like I had said, right. Or, um, not wanting to hand your kids stuff. You want them to work for it and feel the grit that you had to feel and get just as dirty as you did. Right. Um, those are things that you were really wanna notice and say, are these patterns you wanna keep holding onto?

[00:10:04] Jeffrey: right. And, and are they true? Are they real? Are they serving you? Are they serving your kids? If that's the case, right? That's that's definitely, that's huge. Um,

[00:10:16] Katie: So Jeffrey, I know that you were listening to a podcast, um, recently that kind of sparked some ideas in you. So tell me, tell me about this gal and what, what you heard from her. Let's

[00:10:27] Jeffrey: Well, this, this is what kind of brought this conversation up. And our, our, our beloved team member Ashley, uh, turned me onto this podcast, uh, episode by Stacy flowers. If, if you've never heard of her, go look her up. This was a great episode. She's talks a lot about, um, you know, money, mindset and all that kind of stuff.

Lots of different things. Um, she sent me this, this link. I listened to it. It was an emotional, um, an emotional episode. And it made me think of how important this journey is for so many people. Um, Just a snippet of background of Stacy flowers that I learned from this episode is that, you know, she was the only one to graduate, uh, from college, from her family or something like that.

And Stacy flowers, if you're listening and I'm missing misquoting this, I apologize. This is what I gleaned from this episode. But, uh, you know, she, she comes from a, a poorer background. She was the only one in her family to graduate. She had this really high outlook of education and it kind of sparked her journey.

But she, the, the episode was about her going through this, um, Financial journey and being, being the only one in her family, I believe to, to make, you know, several thousands of dollars and to have essentially have more money than, than she needs. Right. That's a D very, uh, uh, um, an incredible. Journey. If you will going from a poor, poor family to being the one in your family that has more money than, you know what to do with right where your tax prepare or your, your, your tax person is saying, you need to spend more money, or you're gonna pay it to the government.

Like who, who of us has that problem? Right? Your tax people are saying, you need to spend more money. Right. Anyway, she brought up.

[00:12:27] Katie: when they say that to me, by the way.

[00:12:31] Jeffrey: You're you're like, okay, that's not a

[00:12:33] Katie: my boyfriend's always like, oh yeah, Katie, Katie hates spending money. Hold on.

[00:12:40] Jeffrey: she, she , she had this Stacy flowers was saying this, uh, this was outlining these three mindsets and there's the broke mindset, the poor mindset and the poverty mindset. And I liked how she described them. Broke mindset is temporary. Like you, you, the way she describes this is that when you're broke. You know, you can make more money, you know, you're gonna rebound you believe it's temporary.

Like that's the key when you're broke, you believe it's temporary. It's gonna change poverty is, is different. There's. I'm forgetting. I don't wanna misquote her on this, but it was more of a, um, situational thing. Like you, you are in poverty, you grew up in poverty. Um, there's a, a hopelessness, or I think, um, you know, kind of a, a, um, a giving up, uh, situation, but that middle ground, that poor. Mindset. That's the one most people live in, even if they're making a lot of money, that's the insidious one that crops up for people, even if you are making a lot of money or enough money, right.

That poor mindset is what comes in and creeps in. And. It's it's that, uh, um, feast and famine cycle. Uh, it's the kind of situation that evolves when you live paycheck to paycheck. When Friday rolls around, you get paid, you blow up the weekend. You cuz you know, you're gonna get paid next week or in two weeks.

Uh, it could be, it could manifest itself in earning a million dollars and having a million. And a half dollars of, uh, expenses, right? Having it doesn't matter how much you have, if your expenses are more like having this come up, this is, this is that mindset that creeps into every part of, uh, uh, your life and manifests in a way where. I'm kind of repeating myself, but regardless of how much money you're making, you're still in this poor mindset. If you can't keep it and grow it and manage it. And essentially people in the poor mindset think, oh, money can solve my problems, but the only problems money can solve are money problems, right?

Saving, budgeting, earning. Things like that. They're not gonna fix your relationship. They're not gonna fix your shoes. They're not gonna raise your kids. right. So I thought that was an interesting thing to, to kind of discuss is that, that middle poor mindset where it keeps creeping in and no matter how much money you make, you.

Struggling or feeling like you're on the rat race or it's a feast and famine situation, or you find yourself, you can't pay your bills. You know, all of these kinds of things, creeping in, I've talked too long. Go ahead, Katie.

[00:16:17] Katie: um, no, I, I think, I think it's just important to think through, um, you know, even those of us that are making more. More money than we ever have before that you can still feel poor. Um, or, you know, I think this is true for like people on a weight loss journey. You know, I've noticed this over the years. Um, you know, if somebody comments on somebody that has a bigger body style.

And they may think, oh, wow, that's a bigger person, but it's like, you don't know their journey. They might have shed 300 pounds. This might be the smallest they've ever been in their life. You just, right. We're all on this journey. And we all have these kind of judgements. And so like on the outside, you're like, oh my gosh, that person's a seven figure business owner.

And I know it cuz she's announced it on Facebook every single day for the last year. Um, Right. But people are starting to call out and say, you know what? That may be your revenue, but like, what's your, you know, um, after expenses, you know, what did, what did you actually make? What's your profit? You know? Um, now I, I get a little tired of that as well.

I don't really feel like I need to lay out my expenses cuz I also think that's a. A choice. I mean, I can keep my expenses low and not hire team and run myself to the ground and be like, oh, I made more money than you. Right. Like, but who's happier.

[00:17:42] Jeffrey: and I'm exhausted.

[00:17:43] Katie: And I'm burnt out and you know, so I'm, I'm not really a big fan of that either.

Um, I personally don't really like shouting out how much money I made. Um, You know, anyway, but just that mindset around am I still poor, even though I made a million dollars, you know, I'm still stressed about money or, um, I've, I've over bought or I've. I fell into the trap of, I have to have a big house in a big car and those fancy, fancy shoes and fancy purse.

And, you know, I, I saw that. I, I traveled recently to west Palm beach, um, Florida. I saw like major wealth in action, you know, $40,000 handbags and, and the like, you know, and I just, I remember thinking if I had all the money in the world, I still would not spend it ever on a purse. Right. Like I just. That's just not my thing, but, so anyway, I think just understanding where you fall in that and giving yourself permission to also notice it and say, well, what if I did wanna spend that?

Or, you know, to me, I just value money in a different way. Um, and I never cared about, um, those name brands, but I also like Jeffrey, you had shared a little bit that you had learned from Stacy around like math and drama.

[00:19:00] Jeffrey: Yes, this I felt was so powerful, so powerful. And, and for me, I connect with it because you know, I, you know, me, I, how I feel about drama, it's not a big part of my life. I can't stand drama. That's been a lifelong. I don't like drama. I've never liked drama. I've never been attracted to dramatic situations, not a part of my life.

And so I loved this little thing where she was saying like finances and wealth is. Just a mix of math and drama, right? So when you get a bill that comes in and you have money in the bank, that's math, right? You have a bill for a hundred dollars, you have $200 in the bank. Half of that from the bank is going to the bill.

That's math. Then the drama is the meaning. You attach to that like, oh, but now I'm broke and then I can't afford this and then I'm not worthy. And then I'm failure. And then I'm. Poor or broke or whatever, like then there's drama, you attached to it. But that's the whole key point is you are bringing those stories. Math is math. That's why I love massive so much, right. It, it is binary. It is binary. It is either yes or no, you know, but then you come and you bring this story. You start attaching all of this meaning behind math. Can you afford it? You can actually, it's only a hundred dollars, but you have $200 in the bank.

Can you afford it? Sure. It's done. Just pay it. Right.

[00:20:47] Katie: mm-hmm

[00:20:47] Jeffrey: But then we, we build, we essentially build around this thing, this, this incredible network of drama of what it means. What it, what, what it means to, to be a failure, to be inadequate, to be judged. That's hard, but that, that's what you brought to it.

[00:21:14] Katie: Right. Like those stories are simply stories, you know, that you, you know, you mentioned earlier, you got from your parent, Jeffrey mentioned earlier, you know, you may have got from your parents. I'm like, oh, even deeper than that, you know, if you've ever done any ancestral work,

[00:21:29] Jeffrey: Yes.

[00:21:29] Katie: records, right.

Um, Uh, oh, I'm forgetting this other, um, family constellations, you know, it's in our genes like way even before our parents, um, you know, the depression inserted beliefs and stories, you know, in our genes and things. So, um, you get to pick the stories that you wanna keep telling yourself. And I think. Really leads us into the next point.

We wanted to bring up around making the choice to bootstrap your business versus investing before you make money in maybe a high ticket coaching program. Um, when we bootstrap and I, I, I always like to talk about this, cuz I think about a friend of my dear friend who is really doing well in business now, you know?

Well over six figures, she's. Literally bootstrapping every step of the way. And when I was teaching high ticket sales and talking about that, you know, she shared with me that although she's proud of where she is today, um, because she chose to bootstrap every step, step of the way it took her 10 years. To get the success that she wanted.

And she is certain that if she simply took out a loan, um, and got support earlier on, she would have had success at least five years instead of 10. So she just wished it didn't take so long, but she grew up in ex um, I don't know about extreme poverty, but she grew up in poverty for sure. She shared with us.

And she was saying, um, even for college, she worked full time. And paid for her tuition from her full-time job and put herself through both her bachelor's and her master's degree. And so it was natural for her to do the same thing for business. That was her pattern. And there was pride in earning before spending and there was pride in having the money to do it.

And she was already elevated from the experience that she had from her parents. Um, so there's, I'm not, I just want you to hear, I'm not judging the choice. I understand the choice and I understand the pride behind the choice. Um, and I understand that it took her longer than it needed. right. I grew up with, um, two working class parents and we utilized credit, you know, the sort of quote, borrow Peter to pay Paul. I grew up with that. And I grew up with that without shame, actually, you know, my mom would say like, Hey, don't be afraid of credit. It's here to use it responsibly. And so she had my sister and I get our own credit cards at age 18. She taught us about, um, credit credit limit, you know, credit scores, um, and you know, to use it, don't be afraid to use your card.

She would say, use the card and pay it so that you're building credit. That was one of the most valuable life lessons that I got because when I started getting into buying a home or buying a car, I had excellent credit and still do. And anything I've wanted to do for my business that I couldn't afford.

I got a loan for it. And I'm a big spender. And I, you know, it's kind of a joke because Jeffrey and I are like the non-married business partner, couple right? Like , we're like the brother sister business partners, and he is more saver and I'm more of a spender, you know? And so we have to balance and it's great because we balance each other out.

And my partner always picks on me and my parents would always say, oh, Katie, she doesn't let a whole, you know, money burns a hole in her pocket. You know, it goes out as quick as it comes in. I'm not afraid to spend and I'm not afraid to invest. And so the level of success, I have no idea, my level of success versus my friend who bootstrapped.

We don't talk about money in that way, but, but I think I experienced success faster than she did because I had support every step of the way. So it it's mindset

[00:25:27] Jeffrey: where, where, where my wife would say, honey, it's okay. You can buy another pair of pants. You can, but I'm like, but I already have one. What do I.

[00:25:35] Katie: I know, oh my God. Oh my God. Yeah. And I'm like, oh, well, I haven't bought like two new pairs of pants this month. So no, I'm really not that bad. Um, because I would much rather buy things for my business at this point. Right. So I prioritize my spending for sure. And I definitely invest in my business more than anything in my life.

Um, But it there's a mindset under it. And that's what I'm getting at. You know, my bootstrapping friend, her mindset was pride to work hard, make the money you need and then buy what you need. Right. And my mindset was credit is not bad using credit to get where you need to go is not a bad thing. As long as I'm responsible with making payments and, and again, making choices of buying things that make sense. and saying no to things that I don't feel ready for. And the only reason why I can now make those choices is cuz I've made the wrong choices. You know, my very first investment in the coaching industry. I'm not afraid to share here. Initially, my initial investment was $17,000. Now you can go get a life coach certification online for 25 bucks.

Right now you can get one for $500 and get one for $800 and you can get one for $25,000 or more. Right. Um, if you sign up to work under the Bob Proctor model, right? Like that was different, um, you know, different pricing and he had a different wealth mindset and he attracted people that were looking to change that wealth mindset by investing a lot of money.

In this program. right. Um, and not that against Bob Proctor, but that's just an example that came to mind and that's not who I invested in, but who I invested in, you know, and it was, um, you know, come learn how to be a life coach and then you can, you know, make $10,000 a month. Well, as a, as a former school teacher at the time, I was a school teacher earning $3,000 a month.

[00:27:32] Jeffrey: mm-hmm

[00:27:33] Katie: $10,000. I mean, that was gonna blow my mind. And I just said yes to the dream. I, um, remortgaged my house and, and paid for this in that way. Um, and everyone thought I was crazy and I just kept coming back to them saying, well, what's the difference if I went and got a master's degree,

[00:27:50] Jeffrey: Yeah,

[00:27:50] Katie: This decision was changing my career.

I was leaving the teaching career. I was going into the coaching industry and you wouldn't Batten eye. If I was gonna invest 80 grand in a master's degree, but you're judging me for investing 17 grand in a life coaching certification. Like to me, it just made sense. Um, and then I ended up kept reinvesting because of course it didn't happen as quickly as they promised cuz it never seems to do that.

Um, and there's a lot in the way of, of going from being a teacher, to being a paid coach in terms of learning how to sell. And so I kept reinvesting reinvesting. So by the end of my time with that company over a two year period, I paid $25,000 and I earned 2,500 and I was bitter. I was really bitter and I, all I wanted to do was quit my job.

I still couldn't quit my job. Now I'm paying off this second kind of mortgage that I grabbed as a home equity line of credit. Um, and I was just really bitter and then good luck making money when you're bitter about spending money. Right.

[00:28:51] Jeffrey: right.

[00:28:51] Katie: Um, so anyway, just to make that long story even longer, um, I had to cut my losses and cuz I, my stubbornness was, I am not gonna invest again until I make $25,000 in my business.

And I, I kept that for about six months and then thank God I found a new community and new mentorship that I valued more and, you know, just, I, I clicked with better. Um, and I learned like that bitterness and that like, Right there. That story, I told myself that I can't invest, or I won't invest till I make 25,000 was just holding me back in this rut.

And the minute I changed my mind and reinvested again at 15,000 more dollars, guys, let me remind you the home I came from there's no mom and dad given me money here. I literally was leveraging credit. I was leveraging my good credit score and I was leveraging, you know, my home and whatever. Anyway, I signed up for this, um, $15,000 thing.

And that is when everything turned in my business and I made my first $10,000 month within months of joining that new community. Like I needed to get out of the rut mindset that I was in and I needed to change my mind. Like, although maybe my first investment of that 17,000. Wasn't a great one. And I think I jumped the gum too soon.

I wasn't ready for that big of an investment. Being brand new to business. Um, and that was just me personally. So I'm just saying I had to learn lessons so that now, even though I'm a spender, I don't buy everything. I see, I do pause and ask myself, like, what are the goals I have? And is this decision based on a goal I have for three years from now, or a goal I have for right now.

And that's how I know if a program is the right, the right program for me. Um, so, so that kind of mindset back to the debt is bad. I personally think because I didn't have that mindset. I got a lot further in life, um, in, in business.

[00:30:59] Jeffrey: Yeah. And I, and I think that brings up the point of, um, like somebody like Abraham Hicks or even Bob Proctor or something would, would, would point out the fact or the idea, the concept that, um, The internal resistance. We have to certain things around money, whether it be debt or if we think wealthy people are assholes, or if we think, you know, showing off wealth is, um, not Christian, you know what, whatever this belief structure we have around wealth, like that's another huge factor that.

Pushing wealth away from a, from an energetic perspective. Um, you know, when, when you allow it to come and go to flow, even hoarding it and thinking I can only save, I must save. Right. That's a form of pushing away. The flow of money. Money is a flow.

[00:32:03] Katie: yep. Yep. And you know, of course there's value in saving. Right.

[00:32:08] Jeffrey: Sure.

[00:32:08] Katie: But, but like there's also value in trusting when I exchange the energy of money by paying for something, it will come back to me.

[00:32:18] Jeffrey: and, and it's about that.

[00:32:19] Katie: hold on. You think if you're holding onto it, then you're then the belief underneath the holding onto it is I don't believe that it's gonna come back.

What if it doesn't come? Like I don't trust, not belief, but I don't trust. It's not gonna come back. Um, and so I can't believe we've already been chatting this long. Um, but I, I, you know, I also just wanted to chat a little bit about, you know, this concept of the safe zone. You know, I sent an email today and this, um, quote came to my mind. Around like why your safety zone is sometimes the most dangerous zone for you to be in, which obviously feels like an oxymoron. I understand. Um, but. When we're always making decisions from this safety, you know, I'm a spender and I make decisions from that. That's my pattern, right? That's my safe zone.

Other people are like, I'm a saver and that's my safe zone. Well, sometimes I overspend and sometimes these other people, folks are overs saving. Again, it's not that you're bad or wrong if you're a spender or a saver, but that, what if you shift the way you've been living life, you shift the way you've been making decisions to do the opposite of the way.

You've always done it. Just to shift and make a pattern. Interrupt. And that forces you out of the safety of, of comfort. Cause like in being in sales, I hear a lot of people will say, you know, now's not the right time. Um, you know, the, my being facetious my most, um, You know, my favorite, uh, objection. I hear all the time, but I'm saying favorite with quotes around is, um, I need to make money first,

[00:34:02] Jeffrey: Yeah.

[00:34:02] Katie: right?

So that their safety zone is kind of like my friend, the bootstrapper right. I need to earn. And then I can, you know, but when it comes to business and you think about, well, I'm gonna open up a restaurant and I'm gonna buy a bunch of food and I'm gonna invite people in. And when I make money, I'll buy the tables and chairs. Just doesn't work that way, right? No one is gonna come into your restaurant if you don't buy tables and chairs. And so, although that's a concrete example, if you think about being an online expert and there are things that you're like, I'm not gonna invest in that until I make money. Is it the sense of inviting someone to your restaurant with no tables and no chairs?

Do people look at you from the outside and say, why are you doing it that way? Right? Or you're so frazzled, your systems are completely broken. Right. Like, you know, we, we booked a, um, a time to go test out e-bikes and, um, the reminder email kind of gave a phone number instead of an address. Like we're going to test e-bikes like, what do you think I need more, a phone number or an address.

Right. But like, just things like that, like when your system doesn't make any sense and it's caus. Frustration for people. And they're like, I'm not gonna buy from you because you know, you never answer my emails or your out of office. Email is talking about a vacation you took in may and yet it's August, right?

Like it just, you know, there, there are things that, um, You have to understand like, oh, I, I need to invest in somebody to help me with these loose ends that I don't have time to fix, or I need to invest in a system that works and stop trying to do everything manually, or I need to invest in a program and learn how to do this the right way, because I've been trying to figure out on my own getting free downloads and watching free YouTube videos.

And it's still not working. Right. Like get out of the pattern. That you are in, whether it's trying to learn for free or trying to make money before you spend it, get out of that pattern and see what happens when you just shift that.

[00:36:02] Jeffrey: Yeah, and I, I, I love that it's, there's no judgment of whether or not that pattern is, is good or bad or, or, or saving is spending is good or bad, but if it's a pattern for you, and if that pattern is causing imbalance in your life, then shaking that up, could rebalance things and shift energy. So,

[00:36:26] Katie: Yeah.

[00:36:27] Jeffrey: um, Was there any more points you wanted to bring up Katie?

[00:36:34] Katie: You know, uh, one other thing around this whole safe zone thing. And I say this with, with all the love in my heart, because I work with, um, so many healers and very empathetic people who use the feeling in their body to make decisions for them. . And so I would, you know, when I was in a sales role for another company and, and people would say, you know, well, this doesn't feel good in my body, so I'm gonna say no.

And I would always come back and say, well, you know it, I mean, obviously if the program felt like a good fit, we, we got, we determined the program was the right fit. They loved the community, you know, we determined they really wanted it, but didn't feel good in their body. And I would always say like, just because you feel nervous in your body, All it, it doesn't mean it's wrong, right?

It means that you are in your safety zone and now you're taking a step out. You're considering taking a step out and your body's like, whoa, hold on a second. We've been very safe here. Not spending any money. And now I'm feeling really scared to invest $15,000. Like that's how much we are selling the program for.

It's scary. And I would always say to them, if you weren't scared, I would be concerned about you. It's always scary to invest that amount of money, but just because it doesn't feel quote unquote good in your body. I just want you to dig deeper into that story. You're telling yourself and say, well, what is the feeling right?

Is it a, is it a hell? No. Or is it a E. because those are very different stories that you're telling. Um, and so don't always fall back on the, this doesn't feel good in my body because fear, isn't always a wrong feeling. It's just a scary thing. It's a new experience that your subconscious mind isn't aware of how to react to. And I think

[00:38:24] Jeffrey: that's tricky. Yeah. And, and I think that's really tricky. I think it's really tricky because, you know, depending on who you're talking to, a lot of us get the advice that, you know, let me check in with my body to see how that feels. Let me check in with my body to see how that feels like. And, but if you're doing something that is.

Anxiety provoking, but it is maybe the right thing to do. Your body may not be telling you the right response.

[00:38:53] Katie: Yep. Yep.

[00:38:55] Jeffrey: Hmm. So, so let's talk about how do we, where do we go from here and how do you, how do we get out of these, um, traps? You know, and I, I. One thing to, to really start with, to begin with no matter where you are on this journey, I'll preface this by saying no matter where you are on this journey, whether or not you're, this is the first time you're hearing about wealth mindset and, and money, mindset and beliefs and things like this.

Or if you have already dedicated, you know, years, years to, to changing this, no matter where you are, there's always a deeper, always a deeper. and tho those deeper levels I'm talking to, especially those people who have already dedicated years to this, and they're thinking, man, I've done so much work and so much work.

And I'm I'm, I'm there. I'm fine talking to you that those details are the hardest. It's that final little nuanced detail that's holding you back from the next level.

[00:40:06] Katie: right. I was gonna say like, I don't even know if final's the right word, because we purposefully used the word journey today. You know, this, this is a journey. And no matter, like we were talking about earlier, no matter how much money you have or you're making, or you don't have, and you're not making it is a journey.

I mean, all of us started at zero

[00:40:24] Jeffrey: It it's a journey without a destination. Right. It's a journey without a destination, but you do get to enjoy it along the way. So.

[00:40:34] Katie: so, you know, there are patterns that you're gonna be shifting so that your journey is onward and upward.

[00:40:41] Jeffrey: Yep. So, so listen to these, uh, a few takeaways here and see where they resonate and, and, and pick one and start there, you know? So, so the first one here is, you know, gain awareness of your words and your feelings about money. Like that's where our beliefs. Come from. So if you're starting at the place of beliefs and starting to shifting shift your beliefs, start listening to the words that you're saying about money and the feelings you're having about money.

For example, if you're still saying things like I can't afford that huge red flag, huge red flag, right. Uh, if you are paying bills and you're frustrated, like nobody feels good about paying taxes, but what's your level of frustration when tax season comes around? What, what is your level of frustration or fear or anger when you know, a bill comes in that you have to pay, um, you know, these things are the evidence that there's work to done. And I guess the next one, you know, recognize and shift those patterns. So if you, if you can recognize that you are a saver or a spender or somewhere in between, um, you know, recognize the pattern and, and challenge yourself to so often shift that pattern and. And, and try to rebalance, I guess, I guess the purpose of that is kind of rebalancing that energy and energetic pattern. And go ahead. Go ahead.

[00:42:28] Katie: I, I was gonna say like, it just, you know, I think we have to be cognizant of when we try to make a rule a hundred percent true instead of a guideline,

[00:42:37] Jeffrey: yeah. Yeah. Oh, huge. Huge. There, there is no like one size fits all. This is the way to do it, and this is the right way to do it.

[00:42:45] Katie: Yeah. Yeah. Um, I wanted to say when you were saying recognize and shift patterns, um, you know, when you were talking about, you know, paying bills, you know, do you feel that like, you know,

[00:42:57] Jeffrey: yeah.

[00:42:58] Katie: um, or when tax time comes, you know, do you get like annoyed that you owe the money to the government or, you know, um, I, in my checkbook, I know who has checkbooks still,

[00:43:09] Jeffrey: What the hell is that

[00:43:11] Katie: Um,

[00:43:12] Jeffrey: up a checkbook. Ladies and gentlemen,

[00:43:13] Katie: I I

[00:43:14] Jeffrey: is a checkbook in her

[00:43:16] Katie: in my checkbook, I have this little note at the top here. Jeffrey can vouch for me and it says money comes to me easily and effortlessly, and in ever creasing amounts with a smiley face. And I wrote this on a sticky note in 2012. And you guys believe me, cuz that's when you maybe had your last checkbook was 2012 but I am not kidding. 2012, I wrote that down in my journey. My, my beginning journey of being a life coach started in 2011 and I obviously had to do a significant amount of, um, money mindset stuff. But anyway, that kind of stuff, it works, it works and, and the gratitude. Thank you so much. I have money to pay for this.

[00:44:01] Jeffrey: Yeah. And that's kind of like the, when we talk about the beginning journey, the beginning of the journey, it really does start with making a choice, becoming aware, acknowledging that you are where you are. That's. You know, and here's, here's, here's the, here's the key you acknowledge where you are, but don't judge where you are, right?

The judgment is what keeps you there. The awareness without judgment allows you to say, okay, it is what it is. I am where I am. Where do I want to go? And how do I get there? And so this brings us to the third point here is that make this a study. Of awareness, no matter where you are, if you're in the middle of the journey, if you're far along on the journey, or if you're just barely starting out, this is a study of awareness where your attention goes, where your words go, where your emotions go, where your patterns go.

This is a study. And if you can do it without judgment, then you're gonna make, I don't know, faster progress than . If you keep beating yourself up about not being to the end goal, right? There is no, there is no end. There is no end, right? You are where you are and you're on this journey. There is no end. So you can't say I'm not there yet because there doesn't exist.

[00:45:41] Katie: Right.

[00:45:42] Jeffrey: All right to, to wrap this up. I can't leave this conversation without everyone collectively wishing Katie a happy birthday, because today is Katie's birthday. Happy birthday,

[00:45:59] Katie: Thank you.

[00:46:02] Jeffrey: Any final

[00:46:02] Katie: everyone records a podcast on their birthday.

[00:46:05] Jeffrey: I know, I bet she was wishing she had the day off.

[00:46:09] Katie: you know, it helps that I just took a vacation. So I'm like, ah, it's just another day. It's fine. Um, but thank you. Thank you. And you know, it is, uh, you know, speaking of journey, it's just. Really cool to look back on like the age I was when I made, you know, my choice to kind of shift careers, shift my money mindset, shift my, um, determination to get out of that constant cycle of when's pay day.

[00:46:38] Jeffrey: yeah. Yeah.

[00:46:39] Katie: You know, and, um, so it just, yeah, feels good every year. I get older, I guess it just, the birthdays become less important, but the day itself, the day itself becomes less important, but just the lessons and the journey, you know, it's like the forties have just been so much, um, about growth. Um, so I appreciate that.

Anyway. Thank you, Jeffrey.

[00:47:00] Jeffrey: Yeah. Any final words you wanna wrap up this episode?

[00:47:05] Katie: You know, I, um, I think that no matter where you are in the, in the journey of wealth, um, it's trusting that it's gonna get better from here,

[00:47:14] Jeffrey: Yeah.

[00:47:15] Katie: right? If that's one of your mantras, it's gonna get better from here. It keeps getting better and better. Thanks so much for where I am and it's gonna keep getting better and better,

[00:47:23] Jeffrey: Yeah. Even if you're a seven figure earner right now,

[00:47:27] Katie: Yeah.

[00:47:28] Jeffrey: right.

[00:47:28] Katie: know, can it be seven figures with, you know, less time on the clock for. Then it got better,

[00:47:33] Jeffrey: then it

[00:47:34] Katie: right. Even if it's the exact same amount of money, but you are ma, but you are working less time, then it got better. so, um, that's, that's the mantra.

[00:47:45] Jeffrey: I love it. All right, dear listener. I really appreciate your time. Thank you so much for joining us. And if you like this episode, we would be so honored. If you were to drop us a review, hit that subscribe button, you know, hit those five stars and leave us a message. We really, really want to hear from. So, uh, you can check out all the show notes at the launch squad, lab.com/episode 82.

And we'll see you in the next one chat for now.

Be the first to know

Enter your name and email and we'll let you know when new episodes release.

About the Show

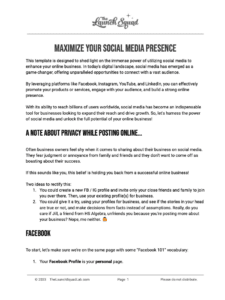

The Lighten Your Launch Podcast is for Coaches and Course Creators who want a lighter online launch experience. Maybe you’ve done a few launches already, and feel exhausted just thinking about it! Or, it’s been one of your goals, but you don’t know where to start.

Tune in to learn from our team of experts, The Launch Squad, who aren’t afraid to dig into all aspects of launching: sales, strategy, technology, mindset, funnels, and even a bit of woo to get you through the toughest times. Let’s put a stop to perfectionism and procrastination, and finally take your launch from intimidating to money-making!

![Marketing Launch Calendar [TEMPLATE]](https://thelaunchsquadlab.com/wp-content/uploads/2023/05/Marketing-Launch-Calendar-TEMPLATE-300x260.png)

![[Updated] Email Templates for Launch](https://thelaunchsquadlab.com/wp-content/uploads/2023/05/Updated-Email-Templates-for-Launch-223x300.png)

![[REVISED] LS Pitch Script](https://thelaunchsquadlab.com/wp-content/uploads/2023/05/REVISED-LS-Pitch-Script-2023-226x300.png)