Jeffrey: Welcome to the light in your launch podcast today, we're talking about money dysmorphia, stay tuned.

Announcer: Hey, we're the Launch Squad and this is the Lighten Your Launch podcast. We teach coaches and course creators how to lighten their launches. We're bringing you all of the tips and strategies to take your launch from intimidating to money-making. In this podcast, we talk about everything; the sales, strategy, mindset, technical and spiritual aspects of running your best launch ever. So if you're feeling overwhelmed and unsure of the next right step, we're here to bring clarity, confidence, and excitement into your next launch. This is the Lighten Your Launch podcast.

Jeffrey: Welcome back to the show. I'm Jeffrey [inaudible] back again with Katie Collins. Katie, would you do the honors and introduce our guests?

Katie: Our guest today graduated first in her class from Georgetown university law center spent a year at a prestigious clerkship on one of the highest courts in the U S while also giving birth to her daughter collected a six figure paycheck from one of the best law firms in the country then gave birth to her son, got divorced, built $2 million plus businesses wrote a best-selling book on legal planning for families and appeared on all the top television and radio shows, but that's not where her story ends. In fact, it was just the beginning. She then walked away from it all moved to a farm and filed bankruptcy so she could find out what was really true about money. And this thing we all pretend is success. As she emerged from her own dark night of the soul, she created the money map to freedom in the lift foundation systems programs to guide us into a new era of wise legal insurance, financial and tax decisions. She was also recognized by entrepreneur magazine as one of the 100 powerful women of 2020. Welcome to the show alley cats.

Ali: Katie, thank you so much. I should have you do my intro every single time. I'm introed.

Katie: Thank you very much. Awesome. Well, we are really glad to have you here, Allie. I just want to set the stage here for our listeners in that, you know, I work with you in a membership program, um, aptly named eyes wide open and, um, you know, it's been just a really great journey for me and for Jeffrey and me. Sometimes I joke that I call it CEO school, um, when we're learning the lift stuff, which I know you'll get into, I just call it CEO school. Like nobody brought me through CEO school. One day I woke up and I was the CEO of the launch squad. And I was like, oh my God, there's a lot. I don't know. Yeah. It's been really nice to have the handholding. And just knowing that any time we've got a question or something coming up, I can go into your Facebook group and really get you to answer my question, which has been awesome. Um, and so you were the perfect guest to bring to the show to talk about, you know, just money in general capital. When is the right time to get loans? When should we not, should we get them under our personal name or our business name? Like things that you just didn't realize our questions until you're, you're kind of facing them. So

Jeffrey: I think it's a lot like parenting, right? No, one's really ready for it. No, one's got a guidebook for it, but you got to find out the information somewhere. Yeah,

Ali: Yeah. I had no idea.

Katie: Yeah. And like, hopefully you're not making the mistakes too, right. Like parenting and money-wise yeah. As you're figuring it out,

Ali: You have to, you do, I think you do have to learn by making some mistakes. And if I, if I would have had the benefit of my insight back when I was building my businesses, I wouldn't have had to walk away from it all and file bankruptcy only to rebuild on a new foundation. You know, it probably costs me, I used to say a million dollars of mistakes. So I had, you know, this million dollar education, not from Georgetown, but from, you know, running, building two businesses to a million dollars and all the legal insurance, financial and tax mistakes I made along the way. But I'm pretty sure it's multiple millions at this point. And I don't think it has to be that way. Um, but in order to do it, you know, in order for it not to be that way, there is this big learning curve and we're the first generation of people really. I think that it had the opportunity to be real CEOs of our own businesses in the way that we do at the scale that we do. And so, yeah, I love that. You're calling eyes wide, open CEO school. That's great. Yeah.

Katie: You can borrow that. Anytime.

Jeffrey: You mentioned this gent that we're the first generation to be doing this. Now I know you have children, so are they embracing your financial wisdom or are, are they just prepared for the world? They're like, they're going to go crush it. And they're going to be the next generation to, to learn on our mistakes.

Ali: Well, you know, kids are rebellious. So my, my kids are 18 and 22 and they're still in their individuation stage. And you know, I'm facing a whole lot of things that my parents didn't face. My parents didn't have money. And, and there's actually a proven phenomenon in the world of estate planning, which is the world that I come out of as a lawyer. And in the world of estate planning, there is this phenomenon of, uh, they call it shirtsleeves to shirtsleeves in three generations. And what that means is that the first generation is going to make the money. The second generation is basically, you know, they're, they're then coming into a reality where their parents have money. And then by the third generation it's gone, and this has been studied, you know, in, in all these different cultures, clogs to clogs in three generations, as you know, like in the Dutch version, right?

Ali: Every culture has it. And so I think that there is an opportunity now to, to change it though. I am seeing it with my kids, right. My family did not have money. Uh, and in fact there was a lot of confusion around money when I was growing up. Um, and now I do have money and there's this question for me of how much am I supposed to create the same struggle for my children that I had now, my, I have that struggle because that was the reality of what I was inheriting. I was inheriting struggle and, and they're not inheriting that same amount of struggle. So for example, recently, um, a couple of years ago, I bought a condo in downtown Boulder. We live in Boulder and I bought that condo to be an asset for my daughter, so that no matter what she would have the safety and security of knowing that that condo is there for her, whether she wants to rent it out, whether she wants to live in it. So she wouldn't have to be making the same kinds of decisions that I feel that I made from this deep fear that I had of being homeless, of becoming a bad lady. You know, I wanted to like root that out and it, you know, brings me to some question around, will she work as hard as I do? Do I even want her to work as hard as I do? I don't know.

Jeffrey: I grappled with that too, you know, in fact, so I've got two kids of my own and I do grapple with the same kind of thing, how hard I worked to get to where I am and what lessons I learned on the way, but then in trying to protect them in certain ways, I guess we're kind of depriving them of certain experiences that they might otherwise have.

Ali: Yeah. It's a really important thing to be continuously in relationship with. And it is ultimately the question of inheritance, right? Which is so interesting because I'm an estate planning lawyer and I was trained that inheritance is the money that is left behind, but it's actually not the money. The money is the by-product, it is the result, but inheritance is really the values or lack of that. We pass on from one generation to the next I inherited values of scarcity and, uh, and, and really in many respects, um, do whatever you need to do to get the money. Those are not the values that I want to be passing onto my kids. And so what I've, what I've gotten to do in this life. And I believe it's actually what I was born for. I believe it's actually what we were all born for is I've gotten to, uh, heal the corrupted values. The extractive values, the scarcity based values that were passed down through my generational line, because all of us, all of us grew up ill or inherited a reality of survival based mentality. Survival-based mentality is what got us here. Right? Think about it. Wars and conflict and poverty and Holocaust. You name it, your, the great depression, the depression, right? Your ancestors, you

Katie: Have everything right.

Ali: And so I think it's up to each one of us to actually mine, the history of our ancestral programming, bring consciousness to it, meaning, bring awareness to it, just look at it, see, what did I actually inherit? That is no longer necessary for me to pass down to the next generation so that I can be intentional about what I'm passing down. And you know, this really ties into your question. You know, the thing that you wanted to talk about with me today around investing in your business and receiving the resources, calling in the resources, borrowing the resources that you need to do that because most of us have inherited a belief system of lack of self-trust that says no way, can I borrow money before I making the money in order to invest in my business, that would be irresponsible. I can't be trusted to do that. I'm going to go into debt. I'm going to end up whatever in bankruptcy.

Katie: Yep. And that debt means something, right? Like when someone's in debt, they have a story in their head. That that means something.

Ali: It means that

Katie: Yes. Yep. Right. I'm irresponsible. Yeah. Yeah. And I keep trying to, I mean, I say this all the time to my, um, to my audience, you know, like tell me another business outside of the coaching industry, which is where we are embedded, you know, tell me another business that gets started with no capital whatsoever. It's like a restaurant that's like, come on in. Oh, but we don't have any food to serve you because we're only gonna use cash. Right. And right. So it's Mac and cheese, but we please give us five star reviews so that we can make a bunch of money and then we can serve you the good stuff. It just doesn't work. No. Why is the coaching industry? This one industry that says I can bootstrap my way. You know, I'm not going to invest to learn sales. I'm going to make

Ali: The money first. It's not just the coaching industry because it's the same in the law industry. Right. I, I train lawyers on this new law business model. Lawyers have been taught, do not invest in your business. It is the, it is the solo preneur. You're in distress, whether you're a lawyer and accountant, um, a coach, a hairdresser, right? It's like, if you have this employee mindset, this solo preneur, I'm going to do it on my own mindset. And what it's really coming from is probably those of us that were raised in a consumer based reality, a consumer-based reality where our parents maybe were not business owners, our parents, we're not creators in the world. Or we were very indoctrinated by the Susie Orman, Dave Ramsey, financial teachings. Right. And what, what do they say do not go into debt, do not use debt no matter what, but they're not talking to business owners.

Ali: Right. They're talking to consumers and it's true as a consumer or even as a business owner using credit and debt as a consumer, which I did the first years of my business. I didn't know how to use debt wisely. Nobody ever taught me. So I didn't know. So that is how I ended up in bankruptcy and why I ended up in bankruptcy. And, and thank God I did like that. That broke me free from any idea around credit and debt being not a good thing. It's funny, right? Because people would they go, if you go through bankruptcy, then you're going to see debt as a bad thing. Now I see that $500,000. I cleared about $500,000 in my bankruptcy a lot. And by the way, if you're going to use credit, I do recommend that, you know, why you use it fully? You don't play small here, right?

Ali: This is the place where you really build self-trust. But when I came out the other side of that bankruptcy and I cleared $500,000, which by the way, I want to make it clear. I did not default on a single dollar to an individual that I owed money to. So if I borrowed any money from a family member or a friend, they got that money back. It was the credit card companies, the banks, the U S government, and they build bankruptcy into their equation. They expect that some number of people are going to default on their loans and it's built into the system. It's actually a really important part of the system, which you can, you know, if you want to read all about it, there's a book debt. The first thousand years, you can like dive in deep to the whole story of it is very important piece of our system.

Ali: And, you know, I had to look at all of that as I went into this like, oh gosh, I've borrowed $500,000. And I don't think I want to do the thing that I borrowed the money to do anymore. And I can keep doing that thing. And if I keep doing that thing and sell enough to pay back that $500,000, am I contributing to the world with what I have to bring to the world at the highest level, versus if I clear that debt, which the law gives me right to do, if I clear that debt pay the consequences, because there are some consequences that come with it and move on to what I really believe that I'm here to do. And I did the equation and the equation said that $500,000 was an investment in you and your own growth. And I did invest it in things that could never be taken away from me, like my education and making a lot of mistakes, a lot of learning trial and error, which I now teach from.

Ali: Uh, and, um, and, and coming out the other side, I was then able to spend an entire year leading up to the bankruptcy, living into the question who am I, if I'm not making any of my decisions based on money. And that was a critical question for me to ask, because, you know, from the moment that I graduated from Georgetown at 27 years old, 26 years old, you know, and became a mom through building $2 million businesses, every single decision I made was based on money, what's going to bring me more money. Where can I go? You know, which law firms should I go to work for? That'll bring me more money. Of course, Charlie monger's firm, because they're giving me a huge signing bonus and they're going to pay me, you know, $185,000 a year. Okay. Go there. Um, you know, to that, how am I going to build my law practice? How am I going to build my next company? What am I going to launch next? What am I going to offer next? Who am I going to hang out with? What events am I going to go to? Every decision was filtered through this filter of money and it felt horrible. I hated that being the filter.

Jeffrey: I want to touch on this bankruptcy just really quick, because I know there's probably a lot of people that maybe even fear that, um, that scenario. So how, how much did that become part of your story when that happened? What was the immediate aftermath? And obviously you've, you've passed it and you're a great success now, but you know, in, in the living, in the moments of it, uh, how much did that become part of your story?

Ali: It was a huge part of my story. In fact, I chose it because when I looked at my options and it's funny, um, do you all know James Al too sure who he is anyway, he's this, he's this, um, commentator of the, of the world, basically James Alisha. And he was a friend at the time and I actually called him to talk to him about what, what should I do? You know, I can go down this road and I can file bankruptcy or there's other paths. There were other paths. Again, I could've made the money and paid it back. I could have done that negotiation and negotiated it down. There was a lot of things that I could have done. I chose the bankruptcy because it was actually a critical piece of my story. I had to choose the most humiliating, shameful thing that I could choose to face the complete loss of my brand, my image, my ego, everything that was constructed around me, that was keeping me from actually knowing the truth of who I was now. I also recognize that at that time, the, the, the, the bankruptcy gave me the opportunity to, it just gave me the opportunity to question everything and to ultimately identify what I now understand as money dysmorphia, money dysmorphia that I would, if had I taken any of the other options, earning the money, which I could have done, or negotiating down the debt and not just going straight into the thing I was most afraid of. That was what I was most afraid of bankruptcy. Oh my God. Yeah. And terrified, like the

Katie: It's, it's similar to the bag lady. I'm going to be living out of my car. Right? Like those are the, that's where our head immediately goes. When we worry about money. Oh, I could become a bag lady. Yeah. Well,

Jeffrey: Except Chemonics death, if you will.

Ali: I had, I have had, I've chosen to die many times during this life. I think it's a critically important part of living well. Um, and then, you know, the bag lady piece, like I, one of one site, once I had cash again and could make investments in, uh, outside of my business again, uh, one of the first things that I did is I built out a sprinter van and, you know, I did a $40,000 build out of that van. In case, in case I actually did need to live in a van down by the river. You know, I wanted to have the resources that I knew I would be able to fall back on no matter what. And this actually became part of my teaching. So when I went through the bankruptcy and I discovered this thing called money dysmorphia, which is the distorted view that we have of our financial reality. And this is a generally passed on distorted view, or comes from the media, the culture, um, financial services industry, um, and their incentives, et cetera, this distorted view, we have of money that causes us to make poor decisions around how we use our non-renewable resources. So we can see this at the macro level on how we make decisions about our global non-renewable resources, which has a spacing and extinction crisis right now. And then we could see it at the micro level of our own non-renewable resources, our non-renewable resources, our time, energy, and attention.

Jeffrey: Yeah. Amen, money, money. We can always, we can always make more.

Ali: You can always make more money. It is infinitely renewable. It is a made up thing that we have agreed to. And it is infinitely renewable when you know how to earn it, access it and use it wisely. And so what you want to do, and this ties into the credit conversation is you want to use money to buy back your non-renewable resources of time, energy, and attention, whenever humanly possible. That is the best equation. That is the best trade-off you can make all day long. Yeah.

Katie: Biggest shifts. Yeah. That's been the biggest shift for me. Yeah. Um, since joining your community is just to, to keep asking myself, is this something that I can be doing or that I should be doing, or can I invest in someone else doing this so that I have the time to do what I need

Ali: To do? And the energy

Katie: Big shift in thinking

Jeffrey: So, correct me if I'm wrong here, this is my what's coming up for me here is that essentially you're teaching individuals how to act like corporations

Ali: And how to use the tools of the legal insurance, financial and tax system with their eyes wide open, to be able to operate as empowered business people in the world who are using these legal insurance, financial, and tax systems, using their businesses to create the economy. So, you know, we have this idea that we are victims to the economy. We are victims to what the federal reserve says, does what the central banks say and do what the big corporations say and do. And from that place, with that mindset, we are victims. It's absolutely right. We are, but the truth is no, we are not, no, we are the majority. We are the empowered creators. Now it will take all of us to actually step into that empowerment, to heal the programming of the past, the conditioning of the current reality, and to understand enough about the legal insurance, financial and tax systems that are here for us to support us, to use the resources, to find the hidden resources so that we can stop sacrificing our non-renewable resources of time, energy, and attention, and start using these infinitely, renewable resources of money to hire people, to use technology at the highest level, and then together be able to collaborate and create more together.

Ali: Because if I am trying to do everything myself and not use money and not invest in other people helping me well, that's a version of hoarding. That is a version of hoarding. And the reality is I'm not the best at everything. In fact, this was a very small number of things that I'm the best at, and when I can pull the resources through me, and this is what I learned the year that I, um, uh, was kind of in the bankruptcy process, is that my role as a creator is to receive the resources and allow them to flow through me, knowing that as long as I have some foundational basics, and we can talk about these foundational basics, I don't actually have to worry about money. I will always make more. And so I can keep flowing it through, keep flowing it through. And I don't have to hoard the money for a rainy day or for the time when I'm going to be retired. We can talk more about that as well, that instead I can allow the currency current currency to stay in circulation, to stay in flow, and then I can create the economy around me. So for example, today, my company will generate about $7 million this year.

Ali: I don't focus on the profits. My CFO, I'm very unhappy about that. We have these constant, we have these constant like disagreements, um, yes, that company, right? So a lot of people will just focus on profits. Okay. That company is $7 million company. Let's say that we were at, you know, focusing on, we gotta hit 30% profits, you know, whatever that would be two and a half million of profits. No, that $7 million is there to support everybody that is served and is serving that company. So that is going to the employees that is going to keep our costs as low as possible for the people that are our clients. I and my partner, my COO and business partner, we are making sure that we're making enough. And for the, you can't see, but I have this little hand motion I like to make, which is building on this foundation of enough. It's critically important that we, we are, that we are paying ourselves enough and we know what enough is. And most people don't. And I have all process for determining that so that we can then share the access, share the wealth. And that to me is really what business is all about.

Jeffrey: That is huge. That is huge. And I think that's a big mine hurdle for a lot of people, because especially if they're coming up from, whether it be poverty middle-class, and they're just trying to deal with things like they want the money to stop in their bank. Right. And they just want that bank number to grow and grow and grow as if it doesn't need to go anywhere else.

Ali: Yeah. And what's, what's interesting is like, if you have that mindset, then once you have a lot of money in your bank, then your whole life, and all of your mental energy is focused on how do I not lose it? What do I do with it? And I learned this from the hundred million dollar man. So right when I was in my hole, you know, letting go of everything and am I going to file bankruptcy? What am I going to do type of inquiry. And just remember that that was happening on the back of having built the $2 million businesses, having written the best-selling book, having been the family, financial and legal expert on TV and being like, something is very wrong here. This is not right. I have to figure out what's actually going on. Uh, and so I'm in this whole question and I met the hundred million dollar man and the a hundred million dollar man was this man that I met that had earned a hundred million dollars.

Ali: He had a hundred million dollars. And, um, and I thought, oh, well, he is going to be the most free human that I've ever met because he's got a hundred million dollars, but he was the most trapped human I had ever met. All he could do is talk about how much money he had, where it was, what form of currency it was in, how he would get access to it. And he was pretty well convinced and probably right, that most of the people in his life were only in his life for the money. Yeah. Such a painful existence. And it also helped me to realize that that's kind of where I had gotten to as well, is like, I wasn't really sure who was working for me because they were inspired or because they just wanted the paycheck. And I felt burdened by everything that I had created because it felt all dependent on me.

Ali: And like, if I make one false move, the whole thing is going to fall in. And then all these people that are dependent on me are not going to be able to take care of themselves. And they're going to hate me. I had a route of that out. And as you're becoming a business owner, and as you're stepping into your leadership and being a CEO and a COO of your business and, and, and really being a leader, it is critically important for you to recognize that as the manager of the resources, because that's really what you are, you are the manager of the resources you are investing in creating something that has to be bigger than just you. And that means you've got to pay people. Well, you've got to have clear expectations for what success looks like for them. And you've got to be in communication with them about what is the growth path for them as well.

Ali: If you're hiring people and if you're hiring vendors, how do you create win-win relationships? So for example, one of the things that I'll see a lot, because people are trying to get as much as possible for as little as possible. That's like one of the themes, right? Let me see if I can get as much as possible for as little as possible. Turn that around. Because if you have a vendor who is under charging you, they are not going to be able to deliver on their promise period. End of story, you are going to find yourself time and time again, wondering why people aren't delivering on their promises, why you aren't getting what you need. And it's because they aren't charging enough. They don't know how to manage their own time, energy, attention, and money. We call these team resources. So you, as a business owner, actually want to be looking for vendors who know how to charge for their services in such a way where they're actually going to be able to deliver on those promises to you. Yeah,

Katie: That's been it. I love a good acronym. Um, that has been huge for me stepping into this role because I've served in a supportive role for many coaching companies in my own journey. And there are some that treated me very well and there are some that quote unquote couldn't afford to pay me, you know? And I just was like, I, I just know I'm worth more than this. So I ended up leaving them. So that was the thing that was happening. They were losing good people because they're unwilling to, or, you know, they're saying they're unable to pay, but I'm just like, Hey, if you're teaching people from the front of the room, make money, charge what you're worth, but then on your team's side, you're paying them not what they're worth. Then your lack of alignment is an energy block. And so when we stepped into this role, that was the first thing I said to Jeffrey.

Katie: I was like, I am not underpaying anyone. I'm not going to undercut anyone. I'm not going to ask for a discount. I'm going to pay them what they ask for. And, you know, like we hired someone that was excellent. And she worked at a low rate and we gave her a raise within like six weeks. It was like, okay. Yeah. Um, so I love that you say that, and I can't believe how many people get stuck in that scarcity thinking around paying their team and their vendors, and then being disappointed one way or the other, like they have a lot of turnover or they're not getting good results.

Ali: So this, this comes from a lack of self-trust. And so this question of, can I borrow money before I have the revenue coming in, also comes from a lack of self-trust. And of course we have a lack of self-trust, where would we have gained this self-trust who taught us how to trust ourselves in this arena? And so it is a process of self-trust building. And I think that that is the single most important thing that we can do as business owners is build self-trust for ourselves. And this congruence piece that you're speaking to this alignment piece that you're speaking to is one of the most critical places that we can build. Self-trust. So I'll just give one little kind of tool that I used, oftentimes when I would feel the fear and the scarcity come up, um, and often, you know, a bill would come in and I'd be like, oh my God, it's so much, I want to like, slow pay that I'm going to not pay it.

Ali: I'm gonna wait. I'm gonna wait. I'm gonna pay it next week or push that off. So anytime you see that or feel that happening in your system, you have the opportunity to reprogram and rewire your own nervous system related to this, pay it immediately pay it immediately, do not hold any bills. Even if you have 30 days as a practice of rewiring your system, pay it as if you ha, if you have the money in the bank. Now, if you don't have the money in the bank and you need to put off paying bills, because you're in a cash flow situation where you actually don't, you need to go out and sell something to pay a bill. Okay. That's okay. Don't pay it right away. Right. Don't go into overdraft, communicate with your vendor, communicate with your team member, let them know what's going on.

Ali: Don't push it into the shadow and hide from it. Instead, reach out proactively don't even make them come after you, right. This is how you start to build alignment. And self-trust, it is okay to hit places in your business where you can't pay a bill where the money isn't coming in for another 15 days, or you need to go out and enroll somebody in a package in order to pay that bill. That is okay, by the way, that's a form of credit that your vendors or your team members are providing to you. It's way better to get credit from the bank way better to get credit from the bank. They're in the business of giving you credit, especially right now, as you know, we're at the end of 2021, and there is massive amounts of credit available at very low interest rates. We are not going to be here again in the future.

Ali: Mark. My words on this, we are, we are coming near the end by the way of a cycle of a lot of money being available. And so if you have been an any question as to whether you should take credit, whether it's in the form of Eid L, which is our emergency disaster funding here in the U S 30 year, 3.7, 5% funding, it's never going to be available again, y'all 0% interest on credit cards, low interest remorse, you know, refinance of your mortgage or buying a home. This is the moment. This is the moment to use credit in like at the, in my, in my, um, estimation at the highest level, like things are going to change. I don't know if any of you remember, but there was a time when credit was 17 to 18%. Like I think in the eighties when I was growing up, I remember that I remember like, and 17 to 18%, it's not affordable at that point, but 2%, 0%. Now you'll have to learn how to use credit cards wisely. It's critically, critically important. Nobody teaches us this because I don't know why. I don't know why they don't teach us this, but,

Katie: And the carts make money because these big companies make a bunch of money off of us being dumb around money. Yeah. So they don't, you know? Yeah. The incentives aren't there out of class.

Ali: That's right. Yeah. Yeah. The, the, the incentives aren't there, it's, it's funny, right? Because if anybody like really could, could zoom out to the macro level, which I think we do, um, they would be able to see that it actually is best for everyone, right. That, that is kind of my mission and purpose is how do we create a world that works for everyone? And, and, and so it is actually best if everybody is educated, if everybody's keeping the money and flow, but it would, you know, dismantle the power and control structures that exist. And I think most people are that have the power and control right now, or really scared of that happening, even though it's going to be better for them. Like they don't, they can't see it yet, but it really is going to be better for them too. Yeah.

Katie: Yeah. They're lacking self-trust we all

Ali: Lack self-trust.

Ali: Yeah. And this is the time. This is the time to build it. And so, yeah. I want to just really encourage everybody. That's listening here to know that if you are a business owner, I like to use this analogy with my lawyers. If you think about a dentist, a dentist cannot start a business without making massive investments in equipment. They can't just build their business out of revenue because they need the equipment to work on the teeth. Right? Yep. Now, what does the dentist have that gives them the confidence to invest, to borrow all that money, to invest in all that equipment that dentist has a valuable service, then that's what they know they have. And so number one is for you to invest in knowing that you have a valuable service. If you do not know that you have a valuable service, do that first get invested in whether it's schooling or coaching yourself or whatever it is you invest in knowing that your service is valuable.

Ali: That the thing that you provide in the world is valuable. If you don't know that first and foremost, it will be hard to build your business and have self-trust. So that's number one, invest in knowing you have a valuable service. Once you know that you have a valuable service invest in building the structures around that service that allow you to charge really well for that service. So what does that mean? It means contracts that allows you to charge really well for your services, with clear boundaries and expectations. It means pricing and packaging, your services in such a way where you are being well compensated and knowing how to, um, uh, engage people in that service, right? Sales. If you don't know how to do sales and sell your service, you gotta invest in learning how to sell your service. That is the single most important thing that you need to learn is how to sell your service.

Ali: Now, you don't want to learn how to sell a service. You don't believe in. That's why I said first and foremost, a service you believe in is actually worth you getting paid to deliver really well on that service. And then the systems and structures for you to be able to offer that service, collect the money, and then you gotta be able to sell that service. And I, I don't believe, I do not believe that for most people, you will be able to learn to sell your service without investing in the support that you need to learn how to sell your service. That is true.

Ali: Gosh, so that those are your tools. Well, those are your tools, right? So, so you're not a dentist, right? You don't have to invest $150,000 in equipment, but you do have to invest $150,000, or probably as a coach, it's not $150,000, right. It could be $50,000, $20,000, but like, you've got to make an investment. So what you want to start asking yourself as the question of where am I going to find the money to do that? Where am I going to find the money to do that? And, um, maybe that's a great time to wrap up by, you know, telling people about the, the challenge that maybe, maybe Katie, this is the challenge that you did that brought you into the eyes wide open community. Was that the reason

Katie: It could have been? And if it, um, I feel like, I think I was already sold on your membership anyway, and I didn't need the challenge. Okay. Got it. Okay.

Ali: Gotcha. Well, that is the focus anyway. Yeah, that was last year as we did this, we create the economy challenge and we help people to look at where to find the money. Um, and that was a big deal because I think that's a big stopping point for a lot of people. I don't, I don't know where the money can come from. And, um, and, and so no, here, here's what I'll say about this is that if you have a vision and you have a service that's really valuable, and you know that you're here to build a business around it and step out of, you know, being dependent on others for your income, um, and you know, really step into this role as an empowered creator and a creator of the economy, the resources are here for you. They are available, they are available. It's just,

Katie: I think that's the most important thing is just where can I find it? You know? And now you're in detective mode, you're out of that defensive, you know? Oh, I could never, I mean, I remember getting the IDL loan, um, in part, because it was almost like you gave me permission to, to really believe in myself. And, and you're like, guys, this is the lowest interest rate ever. You're crazy. Not to, even if you don't need it, put it in your savings account. And I just was like, okay, I'm gonna write, this is something I am learning. So it was like, I was upleveling my own money mindset. Um, I think that's the most important thing for people to realize is that you can always, up-level your, your money mindset. And when you have the capital to invest in the things you really want, that your soul is telling you, this is it. This is the thing. When you have the money sitting in account, because you were smart and you did your due diligence and you found resources to sit on until you needed them. That to me is when things really can open up in your business because now you no longer can or will play small. Yes. And it's just the power of that.

Jeffrey: That first shift is from the, I can't, I can't afford it. I can't to, how can I write? You'll never find the answer. You'll never find a resource available if you stay in. Oh, I can't afford that. Yeah.

Katie: Yeah. That's a practice I've put in for like, I think the 10 years I've been in this coaching industry, I had to stop saying I can't afford it. And that was one of the first shifts that I made. And now I just simply say, I'm choosing not to put my money over there, but that was a huge cause I grew up with those words in my head over and over and over again. And it's a big thing to unwind from. Yeah. So yeah. Yeah. This is awesome. Allie. I know that you had somewhere to be, so I want to, um, honor your time and um, I just yeah. Tell people where they can find you, because I think you do have a challenge coming up and this is the perfect time.

Ali: Yeah. So if you go to, uh, let's see, where's the best place to send folks right now. If you go to eyes wide, open life.com and, um, uh, I'm just going to see if our quiz is on there. Eyes wide, open life.com. Um, actually let me give you a special link where you can take a quiz that I think is really important for you to, for everybody to take, to assess your knowledge of your legal insurance, financial and tax systems. It's at eyes wide, open life.com forward slash lift my Bez, lift my Bez. And that's going to be a 20 point assessment where you'll be able to assess your own legal insurance, financial and tax knowledge and the implementation of your legal and financial legal insurance, financial, and tax knowledge in your business. And if you, um, see that maybe I need to increase my own knowledge around these topics so that I can have the self-trust to be making eyes wide open decisions in my life in business.

Ali: Probably if depending on when you're listening to this, uh, this podcast anyway, watch, watch your inbox for my emails, because we are going to be having a special in October on the lift program, uh, which will support you through the rest of Q4 quarter four, which is the time like Q4 is the time for you to be making a lot of decisions in your business that can either cost you a lot of money, come tax time next, April, or save you a lot of money. Come tax time. Next, April and taxes are your biggest expense. They're all of our biggest expense bar. None, unless we really understand how to minimize our taxes. And so that's what Q4 is about at eyes wide open. How do we minimize our taxes? What do we do in Q4? So that come April, we're paying as little as possible. And, um, Katie, you can look forward to, to that, cause we gotta, we gotta, you know, keep more money in our communities less than the hands of the federal government. And this is the way that we do it.

Katie: I love that. And I don't know if we've spelled out again. I love acronyms. Um, Allie's Lyft acronym is legal insurance, financial and tax. Yeah.

Ali: Right. That's right.

Katie: Yeah, exactly. So that is a powerful program. Yeah. I can't even tell you. That's how I, I aptly named it CEO school.

Ali: I it's funny. Yeah. CEO's school. I think somebody else might have that trademark, but if not, I check it out. Grab it girl. Yeah.

Jeffrey: Yeah. Grab that domain alleys. So thank you so much for spending your time with us. I feel like you're such an interesting person and I feel like we've could have taken this conversation into so many directions. And so we're going to have you back. Yeah. We're probably going to have you back at some point, but uh, just doing the research on you, that you're doing so many amazing things and I think you're rear, you're really changing the world for the better.

Ali: Thank you. Thank you. Thank you. Thank you both for having me and Jeffrey for helping with the attack. Like if you get a chance to have Jeffrey work on your tech, it's a great experience. I'll just say you've got Katie on the intros, Jeffrey on the TAC. I see why they call you the launch squad. Uh, awesome. Thanks so much. All right. Bye Allie.

Jeffrey: Thank you so much for joining us for this special episode. And if you enjoy what you heard here, head on over to wherever you're listening to this right now hit that five star. Leave us a review and then hit that subscribe button. Also, you can check out all the show notes and we'll link to eyes wide, open resources. So you can dive deeper into, uh, Allie Katz's world and become the new CEO that you're destined for. Head over to the launch squad, lab.com forward slash episode 43 and get all those links. Thanks so much for listening. We'll see you next time.

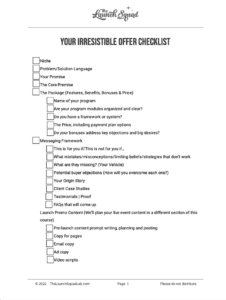

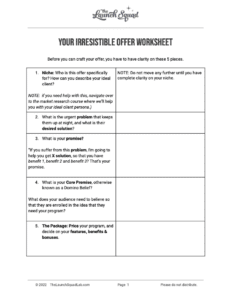

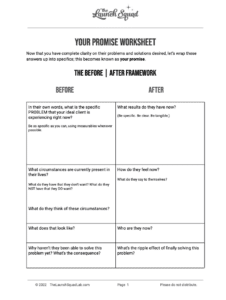

Announcer: Hey, thanks for listening. If you'd like to have clarity, confidence and excitement around your next launch, join us in the Lighten Your Launch Facebook group today at thelaunchsquadlab.com/facebook. We also invite you to download our free gift, the Lighten Your Launch starter kit, the free guide to creating an irresistible offer, pricing it right, overcoming tech barriers, and tapping into the energy you need for success. Get it now at thelaunchsquadlab.com/freegift.

Be the first to know

Enter your name and email and we'll let you know when new episodes release.

About the Show

The Lighten Your Launch Podcast is for Coaches and Course Creators who want a lighter online launch experience. Maybe you’ve done a few launches already, and feel exhausted just thinking about it! Or, it’s been one of your goals, but you don’t know where to start.

Tune in to learn from our team of experts, The Launch Squad, who aren’t afraid to dig into all aspects of launching: sales, strategy, technology, mindset, funnels, and even a bit of woo to get you through the toughest times. Let’s put a stop to perfectionism and procrastination, and finally take your launch from intimidating to money-making!

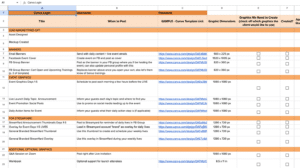

![Marketing Launch Calendar [TEMPLATE]](https://thelaunchsquadlab.com/wp-content/uploads/2023/05/Marketing-Launch-Calendar-TEMPLATE-300x260.png)

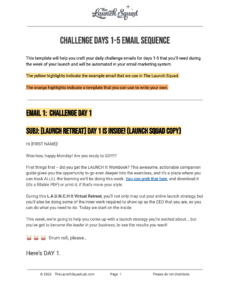

![[Updated] Email Templates for Launch](https://thelaunchsquadlab.com/wp-content/uploads/2023/05/Updated-Email-Templates-for-Launch-223x300.png)

![[REVISED] LS Pitch Script](https://thelaunchsquadlab.com/wp-content/uploads/2023/05/REVISED-LS-Pitch-Script-2023-226x300.png)