In this episode, we want to talk about how to avoid the financial system controlled by wall street and big banks, and instead discover little-known ways to grow and protect your hard-earned dollars.

Our guest today is a man on a mission to help you think differently about your money, your economy and your future.

After graduating with six figures of student loan debt and discovering a way to turn his debt into real wealth as he watched everybody lose their retirement savings and home equity in 2008, he knew that he needed to find a more predictable way to meet his financial objectives and those of his clients.

He is a CERTIFIED FINANCIAL PLANNER, a THREE TIME #1 Best Selling Author, the Owner of Lake Growth Financial Services, a financial firm in Chicago, and co-host of the Not Your Average Financial Podcast.

Over the years, he has helped hundreds of his clients take back control of their financial future and build their businesses with proven, tax-efficient financial solutions unknown to most financial gurus. He has become known as “Not Your Average Financial Planner!”

Connect with Mark Willis

Yes! I want to learn more about the Bank On Yourself® Concept! ➝

Book: Amazon: Mark Willis Book

[00:00:00] Jeffrey: Welcome to the Light In Your Launch podcast. Today we're talking about how to fire your banker, ditch the credit card companies, and become your own source of financing. tuned.

[00:00:57] Jeffrey: Welcome back to the show. I'm Jeffrey Samano. I'm back again with Katie Collins, and today we want to talk about how to avoid the financial system controlled by Wall Street and big banks, and instead, discover a little known ways to turn your back on Wall Street and grow and protect your hard earned cash. Katie, who are we speaking with?

[00:01:20] Katie: Our guest today is a man on a mission to help you think differently about your money, your economy, and your future. After graduating with six figures of student loan debt and discovering a way to turn his debt into real wealth as he watched. Everybody lose their retirement savings and home equity in 2008. He knew that he needed to find a more predictable way to meet his financial objectives and those of his clients. He is a certified financial planner, a three time number one bestselling author, the owner of Lake Growth Financial Services. Which is a financial firm in Chicago and co-host of the Not Your Average financial podcast. the years, he has helped hundreds of his clients take back control of their financial future and build their businesses with proven tax efficient financial solutions. Unknown to most financial gurus, he has become known as not your average financial planner. Please welcome to the podcast stage Mark Will.

[00:02:21] Mark: Hey. Thanks Katie. Thanks Jeffrey. Thanks for having me on.

[00:02:24] Jeffrey: Yeah.

[00:02:25] Katie: for being here.

[00:02:26] Jeffrey: Yeah. So, um, let's start out with a quick little a hundred foot view. Who are you, kind of like, how did you get, uh, to, to where you are now? To, to the not so, um, average.

[00:02:40] Mark: And I get so weird is what you're asking,

[00:02:41] Jeffrey: Yeah. Well, I

[00:02:42] Mark: Yeah. Not your average financial planner. Um, well, it started out just taking what I was told to do, uh, and falling down that rabbit hole of, um, credit cards, student loan debt out the wazo, as you mentioned, uh, Katie and the opener there that Yeah, we, my, my wife and.

It was mostly my debt, but I married two women in college. I jokingly say I married two women, my beautiful wife and Sally May was uh, my other . Uh, very significant other. Uh, so we wanted her outta that relationship as fast as possible. And so, yeah, it was like a, like a monthly Mac truck that would just hit me every time that student loan payment would leave my bank.

[00:03:22] Jeffrey: Mm-hmm.

[00:03:23] Mark: And we wanted freedom. We wanted freedom, and we wanted to do it in a way that didn't waste a half a decade or more of our life just getting out of that problem that I'd created for us. So we were looking for ways to not just be debt free. But be better than debt free. We wanted true resilience to weather.

Any storm, uh, whatever may come because we graduated like, like true geniuses. My wife and I just had the luck of graduating in 2008. Great time to be looking for work . So, uh, we just, uh, found our way through the tough stuff. I remember my very first job was a property management, so I had this nice, you know, comfy master's degree and I was feeling so, you know, smug or whatever.

And my first job to get those student loans paid was a property management firm. And they did a great job giving me a, a, a job when no one was hiring. But my first day on the. They handed me a wet, wet drive act, and my job was to get under that elevator and suck out whatever I could find. Not exactly the master's degree type job you think you're gonna get.

Uh, and the rest of that summer was similar jobs and, and it really brought me down from the perch that you kind of put yourself on when you think you're the bees knees. And yeah, it puts you back in, I think, a more appropriate place to live Your. Your life, especially in your twenties. So, um, at the same time now we've been able to thankfully, um, pay off not just the student loans, but build real wealth at the same time.

We've started a financial firm and that's been going now for over a decade. We've got, uh, with our advisors that work with us over a thousand clients that work all across the country and all 50 states. Uh, and it's been my honor to get to work with a lot of business owners who, you know, they intent. Left the W2 world to swim upstream financially and otherwise.

They want some agency, they want some control, they want some, a belief that they're gonna be the ones to kind of manage their own ship. Uh, they're not just tennis balls floating down the gutter of life. You know, they're moving in a way that they can actually have some sort of maneuverability and control and, and, and.

Out of, of, out of this thing we call life. So that's been my honor to get to work with folks like that. We've worked with real estate investors, business owners, even, uh, NFL Super Bowl champions, but most people I work with are just, you know, folks trying to get some more like freedom, control, and desire for accomplishing their goals without taking a bunch of wild or unnecessary risk.

[00:05:54] Katie: Yep. I, I love that. I appreciate it so much because just know, you know, ever since I quit my W2 job, um, in 2011, no, 2013 I guess is when I quit, you know, and all of a sudden I just became known as this like risk taker. And I, I don't really consider myself a risk taker, but I just got sick of, I got sick of the average. you

[00:06:17] Mark: Right.

[00:06:18] Katie: I

[00:06:18] Mark: Mm.

[00:06:18] Katie: working to afford my home. That was it. You know, I was one of the ones that walked away with over a hundred grand in debt and walked into, you know, being a school teacher for my first job paid me $23,000, right? So, why are we going into debt? Over a hundred thousand dollars to leave school to make $23,000.

[00:06:37] Mark: Yeah.

[00:06:38] Katie: things, I just got so tired of working to live, you know,

[00:06:42] Mark: Mm.

[00:06:43] Katie: literally count down the days to my paycheck. And so any sort of putting money away, you know, people kept telling me, oh, you wanna put money in your Roth ira? You know, up to $4,000 every year. And I would just be like, if I had an extra four grand

[00:06:57] Mark: right? Mm-hmm.

[00:06:58] Katie: would be so psyched to even just take a vacation. But I certainly didn't have four grand to put away. So now fast forward, I'm at this, you know, older age where retirement is like kind of down the road here and I'm like, how the f am I gonna sort that out? Cuz I didn't live that traditional life. Right?

So I think that's why I really wanted to bring this to the entrepreneur. Audience here because I think there's a lot of people that have not lived that traditional life and I think mortgage lending and, you know, credit cards and banking is meant for people with W two s and it's really hard to get a mortgage as a self-employed person who can make $38,000 one month and nothing the next month, you know?

[00:07:41] Jeffrey: Yeah. And, and I think I want to piggyback off that, that it's, if you're an entrepreneur, chances are you, didn't do the traditional anything, right? Maybe you did get a college degree, maybe you didn't, right? But like you're an entrepreneur, which makes you a little bit of different breed right off the bat.

[00:08:00] Mark: That's right. I don't think I've, uh, ever seen a business owner start their business and then have a 401K just fall into their lap.

[00:08:07] Katie: Yeah,

[00:08:08] Jeffrey: right?

[00:08:09] Mark: And, and yet, uh,

[00:08:10] Katie: it,

[00:08:10] Mark: that's right. Exactly. Yeah. And, and yet we all get birthdays. You know, we're all getting older every year. We go around that sun. We all do it together and as you said, yeah, retirement comes whether we're ready or not.

Um, and, but even those with the w2, uh, You know, the wages have not kept up with the rising cost.

[00:08:28] Jeffrey: Mm-hmm.

[00:08:29] Mark: rate in this country, according to the most recent data from, uh, the Fed, is that we're only saving about 3%, 3.0% of our income right now. And that's for everything? That's for our retirement. That's for our emergency fund, that's for our kids college.

That's for the flat tires. Is that even close to enough? I don't think so. So the, the, the W2 pathway is, Is a risk, it's, it's more risky than the business owner pathway, and here's why. Well, one, because wages and all that that I just mentioned, but second, how many bosses do you have? When you have a w2?

You've got probably one boss, and if he or she wakes up on the wrong side of the bed, you're toast.

[00:09:12] Jeffrey: Mm-hmm.

[00:09:13] Mark: You guys know that if you're a business, You've got whatever, a hundred clients, whatever you've got, that's a hundred people. If one leaves, whoops, sorry about it. Right? You got 99 more streams of income. Uh, you might have 99 problems, but income ain't one.

Uh, so I'm happy to say that, you know, the, the W2 life, it's for, I don't wanna say for suckers, because there's a lot of, a lot of good reasons to get that w2, especially if you need it. But man, you're really taking the risk. It's for riskers, I'll say it that way.

[00:09:40] Jeffrey: Yeah. I, I'm glad you brought that up because, you know, that kind of brings in topic of, uh, the world today. Like we, we are in a different, We're in a different world and we're headed into, or arguably in a recession, right? There's inflation going crazy. The one question we asked you to be on here for was really this, are we all doomed?

[00:10:12] Mark: Wow. That's one of the heavier questions I've been asked today.

[00:10:16] Jeffrey: yeah. No, no

[00:10:16] Mark: Yeah.

[00:10:17] Jeffrey: No pressure. Just, yeah,

[00:10:19] Mark: Well, I've gotta say that's, uh, the first time I've ever been asked that. But, uh, you know, depending on your time horizon, I guess the answer is always yes,

[00:10:26] Jeffrey: Yeah,

[00:10:28] Mark: Um, but, uh, on a shorter time horizon, let's say hopefully No, hopefully there's, there's a lot of headwinds.

I mean, you could list these as well as I could. The, the wars that are percolating across the globe, uh, inflation is soaring. Uh, The, I just got off the phone with a business owner who just said his margins have been cut in half or, or worse because of, uh, people just not buying like they did when times were better.

Uh, and you know, I think we've, we've got more volatility in the markets. Heck, even bonds are down. This is the first year that bonds and stocks have gone down at the same time in re in in my memory. Uh, so where's the, where do we hide?

[00:11:07] Jeffrey: Yeah.

[00:11:08] Mark: more importantly than hide, where can we thrive?

[00:11:11] Jeffrey: There's the really key

[00:11:13] Mark: Yeah, you've got, you've got to find out if you need to land your airplane or if you can turn it around.

Like, let's say, you know, I've only had one or two experiences flying an airplane with a buddy. Uh, and you know, this airplane, it could probably do a hundred miles an hour, this little prop prop plane. So if the, if the tail, if the headwinds coming at us, you know, every airplane flies around in an.

[00:11:37] Jeffrey: Mm-hmm.

[00:11:38] Mark: You know, we have to remember that, that every airplane is not just in a vacuum, it's in an environment.

So what is influencing your little airplane when you're up in that airplane, it's a little dingy thing, you know? So it's getting pushed around by all sorts of crosswinds. But if there's a headwind coming at us at 10 miles an hour, sure we can overcome that. But if there's a 200 mile an hour, you know, turbo.

Turbine wind coming right at us. It does not matter how hard our little airplane pushes. We are moving in the wrong direction cuz our airplane can only go a certain speed. Right? So what are our options? We can push, push, push, try to over crank that engine, get to 110 miles an hour maybe, and maybe blow up the whole thing.

We can land the plane and wait it out. A lot of people are doing that right? You know, I'm gonna wait out this recession. No, I'm not sure you can. Uh, or, or if you know how you can use the headwinds and turn it into a tailwind and now your little airplane can go a hundred miles an hour, your, your tailwinds are now pushing you an extra 200.

That's a, that's an amazing, uh, turn of the events, right? Where you go from having a problem pushing against you to being part of your solution. But it's all. Momentum and direction and orientation, and most business owners that I talk to, they're looking for a new orientation. They're pointed toward the headwinds.

But if we can find a way to reorient ourselves toward a way to get that tailwind behind us, then man, anything is possible. And this is not just some fru stuff. This is not just mindset. Wiggle waggle. This is like, let's get technical. Let's get practical. What are the specific financial strategies, tools, products, things that we can use in our tool belt to help us not just, again, not just to hide away from the news, but to actually benefit from it where possible.

[00:13:30] Jeffrey: Okay. I wanna get into that really deep, but first, isn't it just rigged against us? Like how do we get, how do we change the directions of the wind? Like I feel like most of us don't feel like we have any control over the winds. And here

[00:13:47] Katie: Right. We're

[00:13:48] Jeffrey: turn it,

[00:13:49] Katie: stuck in this.

[00:13:50] Mark: Yeah,

[00:13:51] Katie: we're stuck in this system still of,

[00:13:53] Mark: yeah.

[00:13:53] Katie: an, as an entrepreneur, it's like, okay, I need, um, money to build my business. I'm gonna go get a loan. Um, you know, or I'm going to get a credit card and hopefully I can get the 0%, which I ultimately pay for anyway,

[00:14:07] Mark: Yeah.

[00:14:07] Katie: gonna give me a hundred thousand bonus points, but I'm paying $184 a month in interest, right? Like

[00:14:13] Mark: Yep, yep.

[00:14:14] Katie: Um, I think that's the, that's what's spinning in people's mind is, you know, we know the system's rigged against us. How do we not play in it?

[00:14:22] Mark: Yeah. Yeah, man, I got a couple fish, my daughter and I, um, got some fish the other, you know, about a couple months ago now. And it, it's so true. We control the fish's environment. We control when it gets fed, how cold or hot that water is. The fish just swims around, doesn't even realize that it's under like our complete control and it's life is literally in our hands.

And the same is true with our lives. Our money is in an environment just like the airplane was in an. Uh, the question is who is the one at the dial? And so many people I meet think that if they could just get a higher rate of return on their mutual funds or if they could just get that super low interest on their mortgage.

And I'm telling you that is, that is like getting your airplane to go 105 miles an hour instead of a hundred. Trying to over crank that engine, reaching for rate of return is not gonna be our answer here. And working with your investment advisor or whoever to try to get that little bit extra rate of return or finding that sweet investment deal that nobody else knows about.

Is not gonna be what saves the day here. We have to reorient ourselves completely and the power of the the business owner is that we're already doing that. We've already bucked the trends. We've already said we want something different with our lives, our economy. We want to create our own money reserve.

We don't wanna rely on the Federal Reserve. We wanna create our own environment for, and our own economy for ourselves. So who is the one that has the, the temperature gauge on our fish tank? Um, there is no, you know, there's no Wizard of Oz here, but I think there is an industry behind it more so than anything else.

And you. It's rigged. Well, it's been rigged for thousands of years. There's a book out there by, um, David Graber. It's called. Four letter word debt. The first 5,000 years, you know this one? Yeah. The first, the first 5,000 years. What does that tell us? Right. There's a, um, there's a, there's a concept called the Lindy Effect, which essentially just says, Hey, the longer something's been around, the more likely it's gonna last.

[00:16:35] Jeffrey: Mm-hmm.

[00:16:35] Mark: like the opposite of our human bodies, right? The longer we've been around, the less likely I'm gonna last. But this is why we believe that the chair will outlast the iPhone and the Bible will outlast last week's New York Times bestseller because it's existed for these many years, so it's gonna likely last these many more years.

And debt has been around for 5,000 years. So that's the, that's the key right there. That is what controls the environment in which your money lives. In fact, money in many ways is debt, uh, according to David Grayer and a lot of other economists. Now, you don't have to believe me on that part, but debt in many ways, uh, is the foundational fundamental element of half of every transaction in the world, because money is half of every transac.

In the world. So the question is who controls the debt? And the concept of banking is not. Tied to a, um, particular person or foundation or industry or company. Banking is just a verb, right? Uh, so I was not good at English. I never thought about going to England, so I never really focused on the topic. Um, but sorry for the dad joke there.

But the, uh, the, the English verbs are different than say like a, uh, a. I think I caught that when I was in school. So banking is something that anybody can do. Banks as we understand them are usually, you know, the corner store or the mega bank or the, you know, the, the, the kind that we all know and understand banks, they are in their common like metamorphosis.

They are what we understand them to be today. Chase, JP Morgan, bank of America, these guys. But we don't have to use banks to do banking that, where's that written? That we have to use banks to engage in this thing called banking. And I think banking is, yeah.

[00:18:35] Katie: always been.

[00:18:36] Mark: Yeah, that's right. . That's right.

[00:18:39] Katie: That's where it

[00:18:40] Mark: I mean, That's, well, yeah, I'm with you on that.

I mean, I, I grew up, my first memory of money was I had a 50 bucks that I'd somehow accumulated with, you know, lemonade stands or whatever, and I had it in a paper bag in my sock drawer. And my mom took me to the local bank to open up a checking account, and she was doing the right thing, trying to be a good mom.

But I remember my job was to hand over everything I had ever earned, all the hard work in my life, hand over to the stranger. Who said he was gonna do something good with it and keep it safe. Now, I'm five years old. I did not trust this banker. You know, I, I could see right through his thin veneer

[00:19:20] Jeffrey: Yep.

[00:19:21] Mark: and I, I, now, as an adult, I had no clue.

As a kid, of course, but as an adult, I now understand that banks do not keep your money in some sort of alt somewhere.

[00:19:30] Jeffrey: Right.

[00:19:31] Mark: You know? What do they do with,

[00:19:32] Jeffrey: banker,

[00:19:32] Mark: what do they do with it?

[00:19:33] Jeffrey: he had a long twiggy fingers and fangs with wire hair. I

[00:19:40] Mark: Yeah, exactly right. He's like a Simpson's character. Exactly. . Um, but you know, so, so what do you guys think that hap, I mean, if you put 10,000 bucks in the bank, what's your best guess as to what they do with the money?

[00:19:52] Jeffrey: I'll lend it out to somebody else.

[00:19:54] Mark: E. Easy. Right?

[00:19:56] Jeffrey: Yeah.

[00:19:57] Mark: Yes.

[00:19:58] Katie: And

[00:19:58] Mark: Isn't that nuts?

[00:20:00] Katie: a fee maintain your money that they're lending out as well.

[00:20:06] Mark: What kind of racket is.

[00:20:08] Katie: I know.

[00:20:08] Mark: mean, if, if I'm an alien coming from out outta space and I see this going on, I'm thinking, these folks are crazy.

[00:20:14] Katie: Yep.

[00:20:14] Mark: You know? And then my next thought is, how do I start a bank? That would be my next question if I was an alien. Uh, so how do we start that bank? That's a fair question.

All right. So most people think that you have to do a bank like you see on the street corner, but no, you don't. You know, that takes millions of dollars. F D I C insured, bank charter, and decades to get it all set up just to be a one little shop on the local, you know, in your local town. But you can act like a banker and participate in the banking function without having to set up a bank.

So that's kind of my, my fundamental, you know, clear, compelling, to me belief is that you can do what banks do rather. Following the advice they're telling you to follow, banks tell you to put money in CDs. Guess what? Banks don't have CDs in their own portfolio, so they're not even following their own advice.

So what are they doing with their money? Let's go do that instead.

[00:21:17] Jeffrey: So how do we do that?

[00:21:22] Mark: Yeah, that's the, that's the.

[00:21:24] Jeffrey: that question?

[00:21:25] Mark: That's the billion dollar question. Yeah. I mean, so you're right. One way is to literally set up a bank, uh, and then to borrow from yourself or let other people borrow from you. And you could do that, but again, it would take a lot of money and time to do that. Uh, you can forget the whole project and just sort of be that tennis ball floating down life gutter and let the banks rip money outta your pocket.

Or you can look for financial strategies that have existed for hundreds and even thousands of years. That have come right alongside the banks and it's what banks do with their own money. And this is shocking to me, but as a certified financial planner, I didn't get taught this. So I feel like I have to tell the world, um, banks keep a large portion, like we're talking of, you know, the vast majority of their tier one capital, over 80% of their tier one capital, that's the safest portion of their portfolio in life insurance contract.

Of all things. Now, there's a hundreds of ways you can put your mind to work. When you're a bank. You've got all sorts of options at your disposal. Syndications, dynastic, trust, lots of crazy stuff you can't even get if you're a mere mortal like you and me. But, um, these banks get as much as they can buy in these, into these life insurance contract.

So that got me interested. I said, well, why do banks wanna get life insurance contracts? Isn't that the stodgy old stud, the boring stuff that we have to, and how do you even get money into life insurance that it didn't compute? When I first heard this, it was sort of like telling me that I could save for retirement in my auto insurance.

[00:23:01] Jeffrey: Right.

[00:23:02] Mark: it didn't compute to me how do you put money into an insurance contract? But it got me thinking, uh, like how do they do this? So, and, and I'm talking hundreds of billions for every bank. Bank of America in particular, just picking them at random. They own more cash in their life insurance contracts than the total value of all of their real.

[00:23:23] Jeffrey: What for

[00:23:24] Mark: It, it, yeah. It shocks me to learn this, that they, the every Bank of America branch total it all up, and they've got more in their cash value life insurance than they do in their real estate, which shocks me and floors me.

[00:23:37] Jeffrey: Okay.

[00:23:37] Mark: So,

[00:23:38] Jeffrey: Really

[00:23:38] Mark: yeah.

[00:23:39] Jeffrey: I know how

[00:23:40] Mark: I.

[00:23:40] Jeffrey: life insurance. How banks don't die. How does a bank get life

[00:23:45] Mark: I wish, I wish we could find a way to make 'em die, but that's all right. . Yeah. Well they're, they're insuring all the important people at that bank, right. So it's still warm bodies getting insurance on themselves and Yeah. You know, JP Morgan or, um, would've had one, or Jamie Diamond. You know, these guys all have insurance on their bodies, uh, and contracts that.

You can put money into them and save and build wealth within them. And then when that person passes away, the death benefit is also a giant tax-free windfall to the bank. So that's how they use and operate their, um, their, their life insurance. But it, you're, you're right, Jeffrey. There's, there's the kind of.

General notion of how life insurance works for most Americans is you rent it for a while until you can self-insure.

[00:24:35] Jeffrey: right,

[00:24:36] Mark: that's term insurance. And that's really what term insurance is. It's just renting. You rent it for a little while, hopefully you never need it. Uh, you can't build equity in, uh, a rented apartment.

And similarly, you can't build equity. Term insurance. The, the landlord in an apartment will raise the rent on you over the years. And just like that term insurance, they raise the, the rent on you. Your premium goes up as you get older. Uh, and then they'll kick you out when you, when your term is up, you know, just like a landlord might kick you out.

Exactly. Exactly. That's right. That's right. Now contrast that to cash value life insurance, uh, and in particular, A type of life insurance known as whole life insurance. Now, for the listeners, I promise this is gonna make sense for the business owner. I'm gonna try to keep this brief, but this is stuff I really didn't learn, uh, as a kid or even when I was getting my cfp.

So I'll try to keep this as street level as I can, but whole life insurance, if it's dividend. High cash value dividend paying whole life insurance. That's a mouthful. So I'll just call it a bank on yourself. Designed whole life policy bank on yourself. Designed life insurance. If it's a bank on yourself policy, then it builds wealth.

Cash value. That's money I can spend on this side of the grass before I die. That's, that's my favorite time to spend money, by the way. Uh, and, and there is a death.

[00:26:02] Katie: useful.

[00:26:02] Mark: That's right. Yeah, exactly. That's, you can't take it with you. So there is a death benefit still, but I've, I, I, if it's designed properly, you can shrink that death benefit down to get rid of the commissions.

That's where most of the commissions are, and a lot of the insurance expenses. So you cut those out, cut that death benefit down by two thirds if you can, and that floods your policy with liquid. Wealth, that's money I can access. It's known as cash value. And this cash value is the interesting piece. I promise it'll be done in like 90 seconds.

Then I'll love to know your thoughts on all this. So it does four things really well. T G I F to make it really easy for everybody. T G I F. Uh, the cash value is accessible with no taxes due. If you do it properly, it can be designed where it's tax free, like a Roth ira. It grows every single year, guaranteed.

That's the G guaranteed. No matter what the stock market's doing, no matter what real estate's doing, no matter what your business is doing, you can. See that number get bigger and bigger in your cash value every year. And third, it's life insurance of course. So we can solve for that problem that a lot of families need to solve for.

And then fourth and finally, that's so the, I was insurance for those keeping track. And then F is financing. So again, banking my. My thesis here is that banking is the fundamental project that we're all trying to beat when it comes to our financial life. If you control the environment where your money lives, you're gonna win the game.

If a bank controls the environment in which your money lives, the bank will win the game, and it's. Now the plain as simple as that. That's why so many businesses go outta business. So F is financing. How can we become our own source of financing through life insurance? Well, they'll allow you if it's bank on yourself, designed to borrow against the policy, and then you can use that money for any purpose, your personal reasons, by your car.

Send your kid to college, invest in your business, invest in real estate. Do whatever you want with that. And the policy itself will continue to grow. Like you never touch the money. Say that another way. If you've got a hundred thousand dollars of cash in the policy and you borrow out 60 grand to go buy a car or a real estate deal that year, your policy will continue to get growth dividends and guaranteed interest on the full $100,000 as if you hadn't touched a dime of the money.

And that saves every, that changes for me. Everything right? I, it, it, first of all, that sounds not possible, but that changes everything. If you can get uninterrupted compound growth,

[00:28:40] Katie: is that how this differs from the index universal life? That's

[00:28:46] Mark: this, there's a couple of, a couple of big reasons that I don't recommend Index Universal Life, and that's one of them. You cannot get that double asset feature. We call it a non, the, the correct phrase is non-direct recognition. But basically it just means your money can't do two things at once. When you use IOLs like that, you gotta use a bank on yourself.

Designed whole life insurance that, uh, that allows us to do what I just.

[00:29:12] Jeffrey: I don't get why anyone would get any other kind of insurance.

[00:29:17] Mark: There's all sorts of.

[00:29:17] Katie: about this

[00:29:18] Jeffrey: yeah, what, what? How is this new? How is this new?

[00:29:22] Mark: Yeah,

[00:29:22] Katie: Is

[00:29:23] Mark: question. It's, it's not new. It's been around for hundreds of years. It's older than the American Constitution, uh, in this country. And it goes back even further in the uk. Uh, and many bankers again know this, uh, it's sort of like when you buy a red car, you see all the red cars.

[00:29:39] Jeffrey: Yeah.

[00:29:39] Katie: Yeah.

[00:29:39] Mark: it's the same with this.

I didn't ever know about this, but now that I've been in this, doing this for over a decade and, and. You know, lots of exposure to it. I see it all over the place. I mean, JC Penney used it to help him get through the depression, while Disney used a policy loan from his life insurance to start Disneyland. I mean, the, the business owners that have used this are quite, you know, I mean, prolific and even politicians, I mean, um, uh, on both sides of the aisle have used policy loans to fund their financing of their campaigns.

And, you know, the list goes on and on. So it's all over the place, but, uh, we just don't usually.

[00:30:15] Jeffrey: Is there a limit to how much? If you're saying like, this is kind of like your banking, this is your financ. If I have a net worth of 2 billion, I mean, let's just pretend right, let's just for

[00:30:27] Mark: What do you say if for? I mean, come on.

[00:30:30] Jeffrey: when

[00:30:31] Mark: right? Yeah.

[00:30:31] Jeffrey: have a net worth of 2 billion, can I take out a 2 billion life insurance policy and that's my bank

[00:30:39] Mark: Mm-hmm.

[00:30:40] Jeffrey: against that and like

[00:30:42] Mark: Yep.

[00:30:43] Jeffrey: where all my money.

[00:30:45] Mark: Yeah, you can do that. You cannot.

[00:30:48] Katie: is it based on your net worth?

[00:30:51] Jeffrey: can't be legal, by the way. This can't be legal

[00:30:56] Mark: You didn't have no idea how often I get that. And um, so to answer your question there, Katie, uh, it can be based on your net worth, but don't worry if you're like, I was as a young college kid when I started doing one of these, they can also go off your income. And multiply it by your age factor, like an age factor.

So let's say you're making 50 grand a year and you have zero net worth or even a negative net worth like I did when I was getting started, but you're, you know, at a certain age you can multiply that by 30 or 15 or 25. Just take your income, multiply it out. And that's a good rule of thumb for a lot of folks, depending on your age, they'll go off your income or your net worth, whatever you'd like there.

But you cannot get more insurance than you can be approved for. So like if I was. Well, for obvious reasons.

[00:31:40] Jeffrey: working and getting $20,000, $23,000 a year, she couldn't take out a 2 billion life insurance plan.

[00:31:47] Mark: You know that's, that's right. Except on you. She could get that on you. Then you'd have to sleep with one eye open man, cuz she'd be coming, you know, to make sure that she made good on that 2 billion. But, uh, no, you're exactly right. It's, it's all, it's impossible to be over-insured and that's one of the limits of this contract is it's tied to your human life.

A lot of folks, business owners in particular, like I was just working with a gentleman, he's done such a great job in his business, started from nothing immigrant, um, family immigrants. Uh, they, they started a business and now they're doing middle seven figures a year of revenue, 20 employees just crushing.

Incredible guy. Guy, I mean, really good guy. And he's got several business owners or business partners with him. So he's getting a policy on his own life, but he's also getting policies on his business partners and his spouse and kids and more. So there's lots of ways you can accumulate a portfolio of these things, uh, even if you're personally uninsurable.

So even if you don't have great health, let's say, or you know, other reasons that might keep you from getting your own policy, like, you know, income or whatever.

[00:32:59] Jeffrey: Wow.

[00:33:00] Katie: Hmm.

[00:33:01] Mark: So how does this fit into being an entrepreneur? Right, ? Well, alright, so let's say that you're selling shoes and you got 10 other guys and gals selling shoes in your town, and nine of those, uh, 10 of your other competitors. Okay? So your other guys and gals doing this, they're all following the traditional way of begging a.

For lines of credit and hoping and praying that they'll keep that line of credit, hoping and praying that their payables will come in all this, and then the tide goes out on the economy, like it looks like it's starting to do just a little bit

[00:33:36] Jeffrey: Yeah.

[00:33:37] Mark: else sees their lines of credit at the bank get cut in half or even eliminated, which is how banks work.

What's that old Mark Twain quote? You guys know this. Uh, a banker is a fellow who will lend you his umbrella when the sun shines, but once a back is, as soon as it starts to rain. So given that reality, you're the guy or gal here with with your own bank for yourself, where you've got a guaranteed line of credit to yourself and you can actually profit even when you access the money, you still get growth inside your policy of you versus your competitors.

Who's gonna win in.

[00:34:13] Jeffrey: Seems

[00:34:13] Mark: Hard economy. Yeah. It's the tailwind that really makes the difference here. You're all selling shoes, but it was the tailwind of the banking function that made you the profitable, the one that's gonna buy up the market share and, and maybe even your competitor's business. Um, hate to say, but that's, that's the reality of what happens in the dark times like that

[00:34:33] Jeffrey: Huh? raises so many questions. I don't even know where to go. This is, and that's, that's a wrap

[00:34:40] Mark: And that's a wrap. Great show everybody.

[00:34:45] Jeffrey: This, this does. I mean, I feel like this is such a rabbit hole that I think like everyone needs to go down this rabbit hole. Like, why wouldn't we? Why wouldn't we do this? Why wouldn't do this, and why doesn't everyone do this?

[00:35:03] Mark: Yeah, that's a great question. I'll be as candid as I can be. I think people are not aware of this because they've not been told about it. There's plenty of incentive for you to keep your money right where it is. Thank you very much. How big is the banking industry? How big is the Wall Street industry? You know, what's that?

Um, somebody once told me, mark, you know, if you ask a barber if you should grow out your. You can bet what his answer's gonna be. So, you know, it's not like if you go to your typical investment guy or gal, she's gonna say, oh yeah, take all your money outta your stock account with me and go put it over here in this old stodgy life insurance.

No, of course not. They're not gonna say that. And they're not educated enough to, they are educated in their lane like we all are. Um, but they're not. Nobody's got a corner on truth, so they don't have an exposure to or experience with this particular tool. And I'm not claiming to be an expert on every part of the financial universe either.

This is just what I believe is the fundamental success or failure button for most people in their financial life, including my own. So,

[00:36:07] Jeffrey: you, are you selling life insurance?

[00:36:10] Mark: Yeah. Yeah, I sure do. I sure do. I'm a certified financial planner, but I also have a life insurance license, and so I typically don't recommend this to everybody who comes through my doors.

Since I'm a fiduciary and a cfp, there's gonna be a lot of people who come to me who want this, and I'll say, I'm sorry, but this is just not gonna be in your best interest. And we point them. We've got other tools at our firm that we'll point them to instead.

[00:36:32] Jeffrey: Okay. Okay. Why? Why wouldn't that be? Why

[00:36:37] Mark: of reasons. Couple of reasons. First, these are not overnight success stories. Whole life insurance, any life insurance has a cost to it, and you're not gonna get double digit returns on this thing in the first few years, especially, and maybe not ever depending on how interest rates go. So it's boring, steady as she goes, kind of returns.

We're talking middle, single digits now. That is a tax free return. In the life insurance. So you have to compare that if, if you're doing like investments, you'd have to, let's say it's 5% on the life insurance, you'd have to get 8% or whatever, uh, plus fees. So maybe more like eight or 9% on the investments.

But, but that said, um, you could do better with an investment account in the good years of the stock market. Sure could. And a lot of people can't handle that long term H Horizon. They need their get rich this Saturday kind of solutions. So that's one big chunk that we just have to say, I'm sorry. Let's look elsewhere at other projects and financial strategies and we'll go there with them.

Another is the ability to save. If they cannot rub two pennies together, it's just not gonna work. They have either, they need to be able to pump money into this. Or they need to have other reserves, like a bucket of money in their savings account that they could reposition

[00:37:52] Jeffrey: Mm-hmm.

[00:37:53] Mark: we could build for them.

But it just doesn't appear out of magic. Nowhere you've gotta be able to save, and not everybody can do that. So those are at least two reasons there. Mindset of thinking, long range, and the ability to live within your means.

[00:38:07] Jeffrey: That makes a lot of sense. That makes a lot of

[00:38:10] Mark: And I'll just say one more, um, and I'll be brief on this one, but so many, there are 400,000 life insurance agents in the United States. and 99% of them have no clue what we're even talking about right now. , you know, so you guys know more than most insurance agents, uh, which is a shame, but, um, if you design these improperly.

Katie, you were telling me a story, and feel free to share this, but sounds like you were approached with someone who gave you something that sounded like this, but it's categorically different. Do you mind, would you be willing to share any more about that? If not, that's okay too.

[00:38:46] Katie: Yeah. You know, um, it was so long ago and I, I just chose to not make a decision, which is making a decision, you know,

[00:38:53] Mark: Mm-hmm.

[00:38:53] Katie: I. You know, the poor guy, he reached out again and said, well, you never said no. So I'm reaching out to you again. And I'm like, you know, from one salesperson to another, God bless you, Um,

[00:39:04] Mark: man.

[00:39:05] Katie: I can, I can appreciate that.

But, um, no, he was just explaining to me about this, you know, index universal life policy. But what I do remember was if you borrow against it, then you're. Earning money on what you borrowed against. Um, something I loved about it was the story and you know, Jeffrey and I teach this, like with a story lasts so much longer in someone's brain than just facts and statistics.

And so this guy shared a story about, um, you know, his kid needing a car like right out of college or something. And so they. all the money from all the money for the car. From this universal or index universal life, i u l? Is that what you call them?

[00:39:51] Mark: You got it. Yeah. You got all the vocabulary and everything. Good for you.

[00:39:54] Katie: cause

[00:39:55] Mark: Good stuff.

[00:39:55] Katie: it's been

[00:39:56] Mark: Yeah.

[00:39:56] Katie: since April, um,

[00:39:58] Mark: Yep.

[00:39:58] Katie: Anyway, but they, they took all the money and paid for the car so that it was, I don't know if you wanna say interest free, but anyway, it seemed better than borrowing from a car, insurance, financial, whatever,

[00:40:10] Mark: Mm-hmm.

[00:40:11] Katie: the kid to pay back the loan.

[00:40:15] Mark: Yep.

[00:40:15] Katie: like we just took this chunk of money and said, Woohoo, you know, we paid back so that ultimately we got back to that a hundred grand.

And so

[00:40:22] Mark: Mm-hmm.

[00:40:23] Katie: stuck with me as a way to be your own banker in

[00:40:27] Mark: Yeah.

[00:40:27] Katie: And I

[00:40:28] Mark: Mm-hmm.

[00:40:28] Katie: I'm a huge advocate for kids. To learn the value of money,

[00:40:33] Mark: Yep.

[00:40:34] Katie: of having their parents pay for everything or manage all of that. I think, you know, we pump out 25 year olds that don't know how to pay for anything, you

[00:40:41] Mark: Mm-hmm.

[00:40:42] Katie: save or anything.

So I'm a huge proponent of that. And so I just love that story. So that's, that's what I remember about it. And then, you know, it's like, yeah, you have to have money to put in and um, and you know, I was looking at something cause I just paid down all my debt and so I'm like, I can take all those payments. that I was putting to pay down debt now into something else

[00:41:02] Mark: Smart.

[00:41:02] Katie: I, I just ended up not, um, somebody that I care about wasn't in really wanting me to take that path and so I

[00:41:10] Mark: Mm-hmm.

[00:41:10] Katie: couldn't who to listen to. And so I just didn't make a decision.

[00:41:15] Mark: Yep. Well, that's reasonable and thank you for sharing that. Well that's, thank you for sharing that. And I, I honestly know people and I've gone on podcasts even there was a gentleman who, who thought he had one of these that I just described, a bank on yourself type, whole life policy. And he said so on a show.

And I said, well, you know, tell me more on the show. He's telling me all this live in front of everybody and it turns out it's an index, universal life policy. Uh, that is, um, a very, it looks very compelling on paper. I have all the contracts and licenses to give those to clients, but as a cfp, I, I candidly don't feel comfortable doing that.

Be because of a number of reasons, which I won't bore everyone with, but suffice it to say, I'm kind of glad you didn't get into that because there's some significant charges and fees to get out of it. You're kinda locked in, in many ways to an IUL for a decade or more

[00:42:06] Katie: Mm.

[00:42:06] Mark: you get the money. Um, now, uh, what I've done, I'll tell you a story too.

Uh, cause I'm a fan of stories on my own story. Uh, I was throwing all that I could at my student loan debt, and it was a mega payment. It was like a mortgage every month, and I was overpaying for that debt. Throwing more than I, so I was trying to pay it down, but my problem was I was losing all of the powerful dollars that were in my pocket.

Cuz when you're younger, you know, every day, whereas young as we're ever gonna be ever again. And so I was throwing those very valuable dollars into a hole that I'd never see work for me ever again. They're now in Sally Mae's pocket. Doing something for her and her retirement plan. So I said, all right, I need to find a better way.

And so when we stumbled across bank on yourself, it gave me a light bulb moment to say, well, this should be how I pay off my debt, because now I can, I can keep current on all my debts. So I, I, we've now trademarked this, it's called the debt snowbank Method for paying off your debt. And so step one of the snowbank method.

You pay your minimums. Never get behind on your debts. Always pay your minimums. Step two, instead of overpaying on your debts, throw everything you comfortably can into a policy that's designed efficiently like this bank on yourself type policy, whole life insurance. Pack that money into the policy. Your debts are gonna slowly come down as you make your minimum payments over here.

But over there you're gonna see your cash value growing dramatically as you just crank that thing full of money. And then over time, the debt and the the wealth in your policy will equal each other. And so the next step is then to borrow against the policy and wipe out your debts. And we did this with all of our student loan debt and it gave us.

Tens of thousands of dollars of equity in our policy that continues to compound to this day, which is now several hundred thousand and more because we're continuing to pack money into it. But we've paid off all the debt and now we've bought it back for ourselves. We have become our own banker. We bought back the debt.

You know how banks buy each other's debts sometimes? Well, that's what we did. We bought the debt from Sally Mae and she's kicked to the curb now, and now we've even paid off the loan to our. Which was done on our own schedule cuz see, step four, the final step of this whole bank snowbank method is you get to repay the loan on your own schedule.

There's no requirement that you repay it if you never pay off the loan. They just deduct it from your death benefit when you pass away. But if you can pay that loan off, it's, it's now compounding and growing on a much larger number. And you can recycle that money to spend it on a real estate deal or invest in your business or whatever else you might wanna do with.

[00:44:48] Jeffrey: Wow. He

[00:44:51] Katie: So what's the minimum amount of money somebody needs to get started with this life insurance policy that you're talking about?

[00:45:00] Mark: If they're an adult, I assume not for kiddos can be even smaller, but, um, I would say you, you really, the more you put in, the more you'll have. It's just like a savings accountant that way. So if you put in a little, you're only gonna see a little bit. Of course, but I've seen policies for folks who are young adults, early adults, even middle aged adults.

And doing two, 300 bucks a month is probably pretty, like the minimum to really design it properly. Uh, so if you can't do that, we've probably got other projects free to work on first. But, uh, you know, if you can do. If you can't do monthly, but you've got a little bit in a savings account, like we just had a gentleman who he said, I'm sick and tired of my brokerage account getting beat up by the market, so I'm gonna take some of my losses, get a tax right off, and put that into my policy instead.

So that's what he's done. And he's doing nothing per month. It's $0 per month. He just takes the money from his brokerage every year now and puts that into a policy. So there's lots of ways you can structure it. We've even had folks take one lump sum, just dump it in one time, never have to add to it ever again.

[00:46:03] Jeffrey: Okay.

[00:46:04] Katie: if somebody wanted to take something from like their Roth ira, could they do that?

[00:46:10] Mark: It depends. That's a little trickier because it's an IRA and depending on your age and whatever, there may be some early withdrawal penalties, but yes, technically you can do that too.

[00:46:21] Katie: Okay.

[00:46:22] Jeffrey: so when, how early, when's a good time? When's it too late to get into this?

[00:46:33] Mark: There's the cheeky answer and then there's the real answer. Do. The real answer I assume. Yeah. The, the, the cheeky one is 20 years ago,

[00:46:40] Jeffrey: Yeah. Yeah.

[00:46:40] Katie: Yeah.

[00:46:41] Mark: as soon as, you know, as soon as you got a birthday on your, on your, on your, you know, on your birth certificate, you should get one of these policies cuz that's when it costs the, the least per dollar for death benefit.

And that's when you've got the longest period of time to compound your wealth. So I've got policies on kiddos that are just barely out of the hospital getting their policies going and I think that's awesome. Uh, The maybe more honest answer is just, you know, hey, if you can set aside a little bit of money every month or every year, right?

Doesn't have to be a monthly thing. It could be a yearly thing. Now is as young and as healthy as we're all gonna be probably, and we've got time on our side for compounding. This is an uninterrupted compounding growth machine that gets better, the more efficient you go. Now as far as too late, I don't know.

Um, these policies are still efficient. I had a 61 year old start a policy, he put in a lump sum from his savings account and it broke even in three years. You know, so these things. Take some time. Again, there's some insurance expense, but even if you've got a couple extra candles on the birthday cake, it can still work out in your favor.

Just depends on how we design it. That's all.

[00:47:52] Jeffrey: Interesting. So you can really kind of start this by self-funding it. Like if I do have, if I'm really, really old and I've have a savings of, I don't know how much has how much, but if I have a savings, I can move that over there and, and then become my own bank.

[00:48:10] Mark: Mm-hmm. . Yep. Yep.

[00:48:12] Jeffrey: Hmm.

[00:48:13] Mark: In fact, I'll tell another story. There was a guy who had a million dollar line of credit, million dollar line of credit with the bank, and he's a business owner, uses that line of credit every day for his operations sales guys going around the country and all that. So it's a million dollars line of credit, and the bank calls him up in the middle of a downturn.

Uh, for the local economy and they say, we're terming out your loan, and that just means we're getting out of your business and you must pay us a million dollars over the next five years.

[00:48:41] Jeffrey: Wow.

[00:48:41] Mark: he gonna do that? Right? So he's, he is absolutely furious and he says, I wanna fire my banker. I never wanna go through their doorway ever again.

I'll still have my checking account. I'm never gonna ask for a loan from a bank ever again as long as I live. So he's set up a line of credit using one of these policies for himself over the next five years. He paid off the line of credit to the bankers, the gangsters, the gangsters will call him, and he said, funds his policy at the same time.

And he now has more than a million dollar line of credit that he can now tap for any reason. And again, he's become more competitive as a result.

[00:49:23] Jeffrey: Oh boy.

[00:49:27] Mark: You wanna talk about something? I can do that too.

[00:49:30] Jeffrey: this is. Freaking fascinating, and you're just kind of blowing my mind. I mean, this needs to be shouted from the hilltops. I don't, I don't know how else to say it. Like, it just seems silly not to, uh, like I might pick up two for my girls

[00:49:48] Mark: Mm-hmm.

[00:49:49] Jeffrey: this seems ridiculous not to.

[00:49:52] Mark: Yeah, I've, I, I think anywhere, anytime. Um, that's why I've devoted a good chunk of this episode to talking about it, cuz I want folks to at least know it's an option. If you just say no to it, that's fine. I don't mind. I'll be, I'll be okay. You know? Uh, but if, if we can at least give folks the option. What if, I mean this, what, this is a mindblower for me.

Okay. So, Feel free to grab a mop over there if you need to work on, on yours, but my mind gets blown when I think about, what if just 10% of America had something like this

[00:50:21] Jeffrey: Yeah.

[00:50:22] Mark: was the centerpiece of their financial life? Like imagine that for a minute. It gives me goosebumps, like what would happen to the credit card industry?

[00:50:30] Jeffrey: Yep.

[00:50:30] Mark: What would happen to the student loans industry? The, the college crisis would be over the Federal Reserve. They'd have to get part-time jobs working at show's or something.

[00:50:40] Jeffrey: Yeah.

[00:50:41] Mark: you know, this, this would be an unbelievably transformative function for, and, and 10%, that's all it takes, you know, for, for 10% of how many marriages would be saved.

How many, you know, suicides? I mean, the, the list of, of grievances against that four letter word. In the wrong hands. It's, it's the bankers turning up the temperature on our aquarium. And if we could find a way to get those guys out of the bank seat and sit in their seat instead, if you could sit in the banker's seat for your life, like what would change?

That's what gets me outta bed every morning. And that's what gives me like the mindblower moments. So, all right. I'm off my soapbox now.

[00:51:21] Jeffrey: That is a great soapbox to be on though.

[00:51:28] Katie: Yeah, it is food for thought. All right. Let me just reiterate. So if someone wants to ask, I mean, of course we'll find out. Momentarily how people can get in touch with you. But if they have a relationship already with somebody and they would like to ask, um, about this insurance, it's called Whole Life Insurance.

[00:51:47] Mark: Yes. I'm gonna give everybody the long paragraph and then again, I'll shorten it and why do I shorten it? I'll, I'll explain that and I'll try to do that as briefly as I can. Dividend paying whole life insurance designed with paid up additions and a non-direct recognition loan from a mutual life insurance company.

Boy, I'm tired just saying that, and there's probably 20 other pieces. Actually. There are 29 characteristics. It's sort of like, do you remember U S D A organic? You guys know that like at the grocery store, they've got 20 plus things the food has to go through to get that label.

[00:52:19] Katie: Yeah. Yeah.

[00:52:20] Mark: There are at least that many 29 different characteristics that I was able to count to design these things properly.

And so that's why we shorten it. And we've actually trademarked, not me, but someone named Pamela Yell has trademarked the, the phrase by right behind me here, bank on yourself. Uh, for, for them to know, for the buying public, to know that this is what I want. This is the kind of banana I wanna buy at the grocery store.

Uh, If it's bank on yourself, you know that it's met all the requirements and it's doing what we have talked about on this show here today. Um, if you wanna ask your guy or gal about this, I get that, but think about it for a minute. Shouldn't they have told you about this?

[00:53:01] Katie: Mm-hmm.

[00:53:01] Jeffrey: Should have.

[00:53:02] Mark: do you want, do you want.

To teach them how to do this. Is that really like if I'm on the operating table, do I want to be teaching my surgeon what to do next? I mean, no , so there are bank on yourself, professionals all across the country that have been certified and authorized. There are CPAs, they're CFPs like myself. There's, you know, their attorneys, their investment folks.

There are folks all around the financial universe that have that credential. And I'd recommend, if you don't wanna work with me for any reason, that's fine, but find somebody that has that in their, on their website or in their email signature that they are bank on yourself professionals. Then you'll know what you're getting is the real deal.

[00:53:41] Jeffrey: Okay, so the first thing that came up for me is like, okay, if I have. A life insurance policy right now, I've been paying into it year after year after year. Is that a sunk cost now that I've moved to you or some other one else? Or like they're not gonna be able to provide that, is that a sunk cost?

[00:54:00] Mark: Um, well, there's bad news and good news, and it comes down to what kind of life insurance in this case, if it's term insurance. The bad news is yes, that's a sunk cost. You've rented that apartment for 10 years and it's, the money's gone. The good news is you're alive. Great work, so you didn't need it. Now if it's cash value, like an IUL index, universal life or, or a poorly designed whole life, I see that a lot too or worse, a variable life insurance contract that's tied to the markets.

Um, if you've got one of those, I have some good news, you can do a tax free roll. From your old life insurance that you currently pay into, into a true properly designed bank on yourself policy, and that's known as a 10 35 exchange and it's just a tax free transfer from one company to another. You're just taking your business elsewhere.

That's all it is, so that we do all the time. We can look at that and I'd be happy to sit down and chat with folks looking at their overall situation, one to see if it's even the right fit, but two, um, if we should leave that policy alone or if we should do something with it. Good question.

[00:55:09] Jeffrey: Amazing.

[00:55:11] Katie: has been really enlightening and I hope people that are listening can just see, know, we don't have to play by the rules we were taught. Right. Like, just

[00:55:21] Mark: Yeah.

[00:55:22] Katie: well-meaning mom, you know,

[00:55:24] Mark: Mm-hmm.

[00:55:24] Katie: you into the bank. It's, you know, something I say about food to my mother too. It ain't the same wheat you were eating. 60 years ago,

[00:55:33] Mark: Good point. That's a really good point. Mm-hmm.

[00:55:35] Katie: same banking system

[00:55:36] Mark: Mm-hmm.

[00:55:37] Katie: all, all the things have changed. And so we need to stop doing what we've always done and start looking at other solutions. I know we didn't even get to talk about cryptocurrency, you know, bitcoin

[00:55:48] Mark: Yeah.

[00:55:49] Katie: defi, right. But all of these kind of new things that some people are afraid of, some people are embracing and some people are just, you know, un unknowing about, right.

And untrusting, but it's like, I. it's so important for us to evolve. and yeah, start looking at things that, you know, if not everyone's talking about it, then it, you know, it's probably a really good deal. And ahead and grab it while you can.

[00:56:16] Jeffrey: Yeah.

[00:56:16] Mark: right. If, if, uh, if I've learned anything that, uh, that I can rely on now, it's, Hey, if you run with the herd, you're gonna get slaughtered eventually. So find out why we're doing what we're doing. If nothing else, at least you've benefited yourself that way by figuring out why am I doing this?

You know, and then you can decide if you wanna keep doing it. Uh, but that's the hardest part's, just seeing the environment that we're living in, the water of the aquarium.

[00:56:42] Katie: Yep.

[00:56:43] Jeffrey: I think this is so important. And to Katie, your point, like I was having a conversation with my wife who's, who's um, over 50 and she basically was born the year we got off the gold standard.

[00:56:55] Mark: Mm-hmm.

[00:56:56] Jeffrey: anyone older than her has an idea of banking and saving a perspective of, of saving and banking. That's completely different to anyone born after her.

Right. And we. That's, it's a totally different, it's a different

[00:57:12] Mark: Yeah.

[00:57:13] Jeffrey: It's a

[00:57:13] Mark: Mm-hmm.

[00:57:14] Jeffrey: ballgame.

[00:57:15] Mark: That's right. That's right. Hey, well, I've been, it's been an honor to be on your show, guys, and I hope that it's lightened the load for a lot of people, and you guys are doing an incredible job of helping to change how we understand. This launch that, um, so many of your business owners clients are trying to do, uh, where is it written that we have to laboriously go through this all on our own?

Um, and you guys are doing a great job of helping lighten the launch. Um, not to phrase or anything there, so

[00:57:45] Katie: you. Oh my goodness. What a great phrase. We should use that

[00:57:51] Mark: well, thank you for having me on.

[00:57:53] Katie: yeah, mark, how can people get in touch with you? We'll put links in the show notes, but, um, you know, what's kind of your invitation for people to get connected with you?

[00:58:00] Mark: Well again, thank you for having me on and yeah, if you found this interesting or at least like to learn more about it and you're sick and tired of seeing ugly surprises when you open up your retirement account statements or you're getting tired of hearing the banks begging you for another hike in your interest on your credit cards, give me a call.

We can help. Uh, go to bank, uh, well go to kickstart with mark.com. That's kickstart with mark.com. With a k mark with a K. And we'll have a 15 minute quick conversation to see if this tool or another tools that we might offer, uh, would be a good fit. So that's Kickstart with mark.com.

[00:58:37] Katie: Awesome. We'll put that link in the show notes as well as where to find you on social and all the things so we can properly stalk you.

[00:58:44] Mark: Wonderful. I well, it's, it's okay. In this, in this crazy digital world, I guess so. No problem.

[00:58:50] Katie: Awesome.

[00:58:51] Jeffrey: Uh, mark, this has been amazing. My mind has been blown several times and I, I do need to mop around here. This is getting ridiculous. Um, thank you, thank you so much for your time and for being so generous with not only your knowledge, but your time as well. Um, and I'd like

[00:59:07] Mark: My pleasure. Thank you.

[00:59:09] Jeffrey: yes, thank you so much.

And, and I also thank you, dear listener for joining us. And if you didn't, Some amazing nuggets. I, I don't, I don't know if you were listening but if you did,

[00:59:23] Katie: Go back and listen again.

[00:59:25] Jeffrey: go back and listen again. us a five star review, hit that subscribe button, and uh, check out all the show notes at the launch squad lab.com/episode 89 and we'll have links in there, how to get in touch with Mark and, and more.

So thank you so much and we will see you next.

Be the first to know

Enter your name and email and we'll let you know when new episodes release.

About the Show

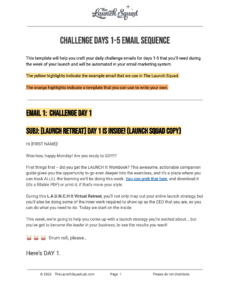

The Lighten Your Launch Podcast is for Coaches and Course Creators who want a lighter online launch experience. Maybe you’ve done a few launches already, and feel exhausted just thinking about it! Or, it’s been one of your goals, but you don’t know where to start.

Tune in to learn from our team of experts, The Launch Squad, who aren’t afraid to dig into all aspects of launching: sales, strategy, technology, mindset, funnels, and even a bit of woo to get you through the toughest times. Let’s put a stop to perfectionism and procrastination, and finally take your launch from intimidating to money-making!

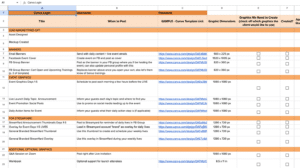

![Marketing Launch Calendar [TEMPLATE]](https://thelaunchsquadlab.com/wp-content/uploads/2023/05/Marketing-Launch-Calendar-TEMPLATE-300x260.png)

![[Updated] Email Templates for Launch](https://thelaunchsquadlab.com/wp-content/uploads/2023/05/Updated-Email-Templates-for-Launch-223x300.png)

![[REVISED] LS Pitch Script](https://thelaunchsquadlab.com/wp-content/uploads/2023/05/REVISED-LS-Pitch-Script-2023-226x300.png)